Given the financial statements for Jones Corporation and Smith Corporation shown here: a . To which one

Question:

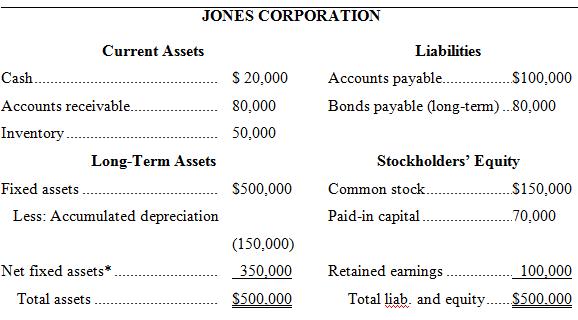

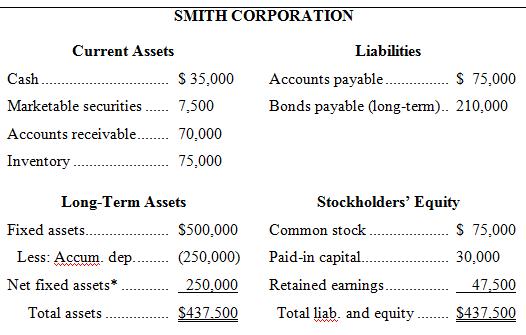

Given the financial statements for Jones Corporation and Smith Corporation shown here:

a. To which one would you, as credit manager for a supplier, approve the extension of (short-term) trade credit? Why? Compute all ratios before answering.

b. In which one would you buy stock? Why?

Sales (on credit).................................................................... | $1,250,000 |

Cost of goods sold................................................................ | 750,000 |

Gross profit........................................................................... | 500,000 |

Selling and administrative expense†................................... | 257,000 |

Less: Depreciation expense................................................ | 50,000 |

Operating profit.................................................................... | 193,000 |

Interest expense.................................................................... | 8,000 |

Earnings before taxes............................................................ | 185,000 |

Tax expense........................................................................... | 92,500 |

Net income............................................................................ | $ 92,500 |

*Use net fixed assets in computing fixed asset turnover.

†Includes $7,000 in lease payments.

SMITH CORPORATION | |

Sales (on credit).................................................................... | $1,000,000 |

Cost of goods sold................................................................ | 600,000 |

Gross profit........................................................................... | 400,000 |

Selling and administrative expense†................................... | 224,000 |

Less: Depreciation expense................................................ | 50,000 |

Operating profit.................................................................... | 126,000 |

Interest expense.................................................................... | 21,000 |

Earnings before taxes............................................................ | 105,000 |

Tax expense........................................................................... | 52,500 |

Net income............................................................................ | $ 52,500 |

†Includes $7,000 in lease payments.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259194078

15th edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen