Given the following information: a. Rank the portfolios on RVAR. b. Rank the portfolios on RVOL. c.

Question:

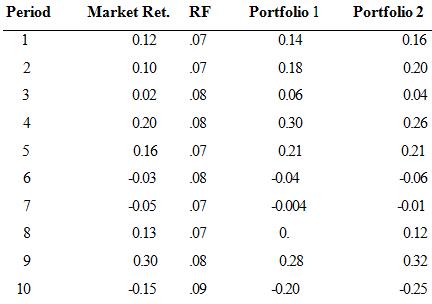

Given the following information:

a. Rank the portfolios on RVAR.

b. Rank the portfolios on RVOL.

c. Rank the portfolios on alpha.

d. Which portfolio had the smaller nonsystematic risk?

e. Which portfolio had the larger beta?

f. Which portfolio had the larger standard deviation?

g. Which portfolio had the larger average return?

h. How are the answers to (0 and (g) related to the results for the composite performance measures?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: