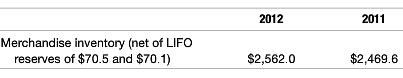

Grocery chain Safeway Inc. discloses its inventory in the following manner on the balance sheet itself (dollars

Question:

Grocery chain Safeway Inc. discloses its inventory in the following manner on the balance sheet itself (dollars in millions).

Rival grocer SUPERVALU Inc., on the other hand, disclosed information about its LIFO and FIFO values in a footnote to its 2012 financial statements. The balance sheet inventory values (in millions) were $854 and $908 for fiscal 2012 and fiscal 2011, respectively.

As of February 23, 2013, and February 25, 2012, approximately 60 percent of the Company’s inventories were valued under the LIFO method . . . . The replacement cost approach under the FIFO method is predominantly utilized in determining the value of high turnover perishable items, including Produce, Deli, Bakery, Meat and Floral . . . . If the FIFO method had been used to determine cost of inventories for which the LIFO method is used, the Company’s inventories would have been higher by approximately $211 and $207 as of February 23, 2013 and February 25, 2012, respectively.

REQUIRED:

a. For which of the two companies is the difference between LIFO and FIFO larger as a percent of total inventories?

b. Compute ending inventory as of the end of 2012, assuming the FIFO method, for Safeway and as of the end of Fiscal 2012 for SUPERVALU.

c. Estimate the tax savings enjoyed by the two companies due to their use of LIFO instead of FIFO. (Assume a 30 percent tax rate.)

d. Why might SUPERVALU use FIFO for “high turnover perishable items”?

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: