Gross Profit Method Eastman Company lost most of its inventory in a fire in December just before

Question:

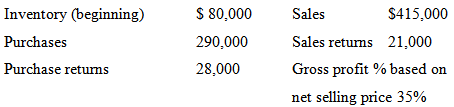

Gross Profit Method Eastman Company lost most of its inventory in a fire in December just before the year-end physical inventory was taken. Corporate records disclose the following.

Merchandise with a selling price of $30,000 remained undamaged after the fire, and damaged merchandise has a salvage value of $8,150. The company does not carry fire insurance on its inventory. Prepare a formal labeled schedule computing the fire loss incurred. (Do not use the retail inventory method.)

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

Question Posted: