Gwen Benson, Ian Blacklaw, and Eduardo Cabrera are sales representatives for Electronic Manufacturing Inc. (EMI). EMI specializes

Question:

Gwen Benson, Ian Blacklaw, and Eduardo Cabrera are sales representatives for Electronic Manufacturing Inc. (EMI). EMI specializes in low-volume production orders for the research groups of major companies. Each sales representative receives a base salary plus a bonus based on 20% of the actual profit (gross margin) of each order they sell. Before this year, the bonus was 5% of the revenues of each order they sold. Actual profit in the revised system was defined as actual revenue minus actual manufacturing cost. EMI uses a three-part classification of manufacturing costs€”direct materials, direct manufacturing labour, and indirect manufacturing costs. Indirect manufacturing costs are determined as 200% of actual direct manufacturing labour cost.

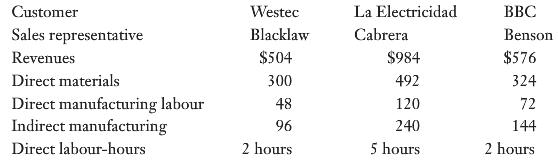

Benson receives a report on an EMI job for BBC Inc. She is dismayed by the low profit on the BBC job. She prided herself on not discounting the price BBC would pay by convincing BBC of the quality of EMI€™s work. Benson discussed the issue with Blacklaw and Cabrera. They share with her details of their most recent jobs. Summary data are as follows:

Benson asks Hans Brunner, EMI€™s manufacturing manager, to explain the different labour costs charged on the Westec and BBC jobs, given both used two direct labour-hours. She was told the BBC job was done in overtime and the actual rate ($36) was 50% higher than the $24 per hour straight-time rate. Benson noted that she brought the BBC order to EMI one week ago and there was no rush order on the job.

In contrast, the Westec order was a €œhot-hot€ one with a request it be done by noon the day after the order was received. Brunner said that the €œactual cost€ he charged to the BBC job was the $24 per hour straight-time rate.

REQUIRED

1. Using both the actual straight-time and overtime rates paid for direct labour, what is the actual profit EMI would report on each of the three jobs?

2. Assume that EMI charges each job for direct labour at the $24 straight-time rate (and that the indirect-manufacturing rate of 200% includes an overtime premium). What would be the revised profit EMI would report on each of the three jobs? Comment on any differences from requirement 1.

3. Discuss the pros and cons of charging the BBC job the $36 labour rate per hour.

4. Why might EMI adopt the 20% profit incentive instead of the prior 5% of revenue incentive? How might EMI define profit to reduce possible disagreements with its sales representatives?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133392883

6th Canadian edition

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ