Hanks Company is developing its annual financial statements at December 31, 2016. The statements are complete except

Question:

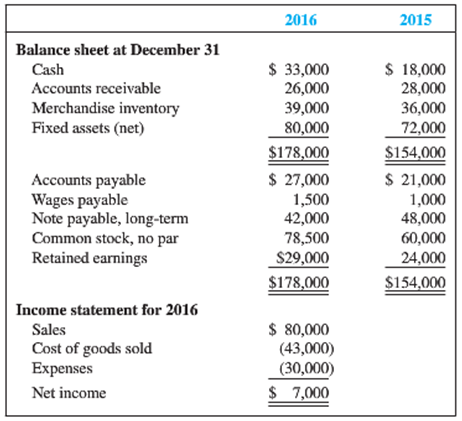

Hanks Company is developing its annual financial statements at December 31, 2016. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows:

Additional Data:

a. Bought fixed assets for cash, $12,000.

b. Paid $6.000 on the long-term note payable.

e. Sold unissued common stock for $18,500 cash.

d. Declared and paid a $2,000 cash dividend.

e. Incurred the following expenses: depreciation. $4,000; wages, $12,000; taxes, $2,000; and other, $12,000.

Required

1. Prepare statement of cash flows T-accounts using the indirect method to report cash flows from operating activities.

2. Prepare the statement of cash flows.

3. Prepare a schedule of noncash investing and financing activities if necessary.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0078025556

8th edition

Authors: Robert Libby, Patricia Libby, Daniel Short