Hartney Enterprises issued twenty $1,000 bonds on June 30, 2012, with a stated annual interest rate of

Question:

Hartney Enterprises issued twenty $1,000 bonds on June 30, 2012, with a stated annual interest rate of 6 percent. The bonds mature in six years. Interest is paid semiannually on December 31 and June 30. The effective interest rate as of the June 30, 2012, the date of issuance, was 8 percent.

Required:

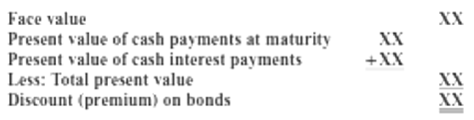

(a) Compute the present value of the cash flows associated with these bonds on June 30, 2012, using the following format:

(b) Compute the present value of the remaining cash flows associated with these bonds on December 31, 2012. What does the present value of December 31, 2012, represent?

(c) what does the difference between the present value of the remaining cash flows associated with these bonds on June 30, 2012, and December 31, 2012, using the effective interest method. Is the amount of discount on bonds payable amortized in this entry the same as the amount found in (c)? why or why not?

Step by Step Answer: