Hawk and Eagle Co., a law firm, had the following costs last year: Direct professional labor .

Question:

Hawk and Eagle Co., a law firm, had the following costs last year:

Direct professional labor …………. $15,000,000

Overhead ………………………….. 21,000,000

Total costs ………………………… $36,000,000

The following costs were included in overhead:

Fringe benefits for direct professional labor ……………… $ 5,000,000

Paralegal costs ……………………………………………. 2,700,000

Telephone call time with clients (estimated but not tabulated) …. 600,000

Computer time …………………………………………………… 1,800,000

Photocopying …………………………………………………….. 900,000

Total ……………………………………………………………… $11,000,000

The firm recently improved its ability to document and trace costs to individual cases. Revised bookkeeping procedures now allow the firm to trace fringe benefit costs for direct professional labor, paralegal costs, telephone charges, computer time, and photocopying costs to each case individually. The managing partner needs to decide whether more costs than just direct professional labor should be traced directly to jobs to allow the firm to better justify billings to clients.

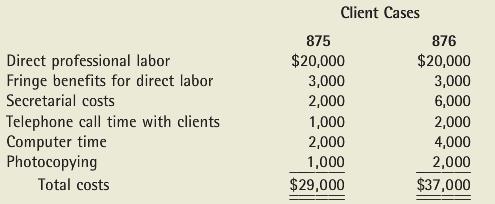

During the last year, more costs were traced to client engagements. Two of the case records showed the following:

Three methods are being considered for allocating overhead this year:

Method 1: Allocate overhead based on direct professional labor cost. Calculate the allocation rate using last year’s direct professional labor costs of $15 million and overhead costs of $21 million.

Method 2: Allocate overhead based on direct professional labor cost. Calculate the allocation rate using last year’s direct professional labor costs of $15 million and overhead costs of $10 million ($21 million less $11 million in direct costs that are traced this year).

Method 3: Allocate the $10 million overhead based on total direct costs. Calculate the allocation rate using last year’s direct costs (professional labor of $15 million plus other direct costs of $11 million).

REQUIRED

A. Compute the overhead allocation rate for method 1.

B. Compute the overhead allocation rate for method 2.

C. Compute the overhead allocation rate for method 3.

D. Using each of the three rates computed in parts (A), (B), and (C), compute the total costs of cases 875 and 876.

E. Explain why the total costs allocated to cases 875 and 876 are not the same under the three methods.

F. Explain why method 1 would be inappropriate.

G. Would method 2 or method 3 be better? Explain.

H. Explain how job costing in a service business is different from job costing in a manufacturing business.

Step by Step Answer:

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott