Hedge funds are sometimes referred to as mutual funds for the super rich. They are typically an

Question:

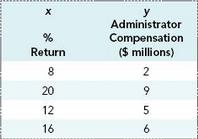

Hedge funds are sometimes referred to as “mutual funds for the super rich.” They are typically an aggressively managed portfolio of investments that require a very large initial investment. In a study using simple linear regression to examine how hedge fund performance is linked to the annual compensation for hedge fund administrators, four cases were included:

Show the data in a scatter diagram and use the least squares criterion to find the slope (b = ====) and the intercept (a) for the best fitting line. Sketch the least squares line in your scatter diagram. Use the line to estimate the constant amount by which administrator compensation would change for each percentage point increase in hedge fund return.

Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Understanding Business Statistics

ISBN: 978-1118145258

1st edition

Authors: Stacey Jones, Tim Bergquist, Ned Freed

Question Posted: