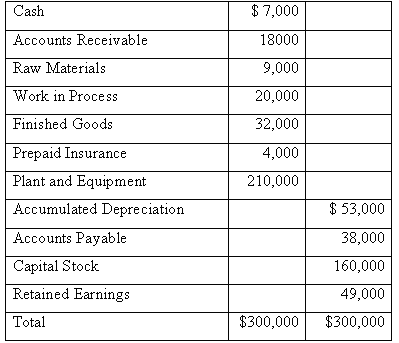

Hudson Companys trial balance as of January 1, the beginning of its fiscal year, is given below:

Question:

Hudson Company’s trial balance as of January 1, the beginning of its fiscal year, is given below:

Hudson Company uses a job-order costing system. During the year, the following transactions took place:

a. Raw materials purchased on account, $40,000.

b. Raw materials were requisitioned for use in production, $38,000 (85% direct and 15% indirect).

c. Factory utility costs incurred $19,100.

d. Depreciation was recorded on plant and equipment, $36,000. Three-fourths of the depreciation related to factory equipment, and the remainder related to selling and administrative equipment.

e. Advertising expense incurred $48,000.

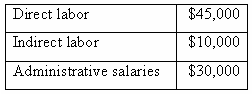

f. Costs for salaries and wages were incurred as follows:

g. Prepaid insurance expired during the year, $3,000 (80% related to factory operations, and 20% related to selling and administrative activities).

h. Miscellaneous selling and administrative expenses incurred $9,500.

i. Manufacturing overhead was applied to production. The company applies overhead on the basis of $8 per machine-hour; 7,500 machine-hours were recorded for the year.

j. Goods that cost $140,000 to manufacture according to their job cost sheets were transferred to the finished goods warehouse.

k. Sales for the year totaled $250,000 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $130,000.

1. Collections from customers during the year totaled $245,000.

m. Payments to suppliers on account during the year, $150,000; payments to employees for salaries and wages, $84,000.

Required:

1. Prepare a T-account for each account in the company’s trial balance and enter the opening balances shown on the prior page.

2. Record the transactions above directly into the T-accounts. Prepare new T-accounts as needed. Key your entries to the letters (a) through (m) above. Find the ending balance in each account.

3. Is manufacturing overhead underapplied or overapplied for the year? Make an entry in the T-accounts to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. (Do not prepare a schedule of cost of goods manufactured; all of the information needed for the income statement is available in the T-accounts.)

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer