In 1991 the average interest rate charged by U.S. credit card issuers was 18.8 percent. Since that

Question:

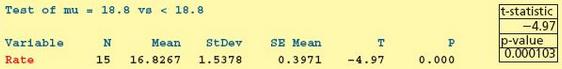

In 1991 the average interest rate charged by U.S. credit card issuers was 18.8 percent. Since that time, there has been a proliferation of new credit cards affiliated with retail stores, oil companies, alumni associations, professional sports teams, and so on. A financial officer wishes to study whether the in-creased competition in the credit card business has reduced interest rates. To do this, the officer will test a hypothesis about the current mean interest rate, m, charged by all U.S. credit card issuers. To per-form the hypothesis test, the officer randomly selects n = 15 credit cards and obtains the following interest rates (arranged in increasing order): 14.0, 14.6, 15.3, 15.6, 15.8, 16.4, 16.6, 17.0, 17.3, 17.6, 17.8, 18.1, 18.4, 18.7, and 19.2. A stem- and- leaf display of the interest rates is given in the page margin, and the MINITAB and Excel outputs for testing H0: μ = 18.8 versus Ha: μ = 18.8 follow.

a. Set up the null and alternative hypotheses needed to provide evidence that mean interest rates have decreased since 1991.

b. Use the MINITAB and Excel outputs and critical values to test the hypotheses you set up in part (a) at the .05, .01, and .001 levels of significance.

c. Use the MINITAB and Excel outputs and a p-value to test the hypotheses you set up in part (a) at the .05, .01, and .001 levels of significance.

d. Based on your results in parts (b) and (c), how much evidence is there that mean interest rates have decreased since 1991?

Step by Step Answer:

Essentials Of Business Statistics

ISBN: 9780078020537

5th Edition

Authors: Bruce Bowerman, Richard Connell, Emily Murphree, Burdeane Or