In June 2008, the PCAOB issued its report on the 2007 inspection report on Pricewaterhouse-Coopers LLP (see

Question:

In June 2008, the PCAOB issued its report on the 2007 inspection report on Pricewaterhouse-Coopers LLP (see PCAOB Release No. 104-2008-125). For one of PricewaterhouseCoopers' clients (referred to as "Issuer A" in the PCAOB's inspection report), the PCAOB noted the following:

In determining the fair value of the reporting units for its goodwill impairment analysis, the issuer added an amount ("award allocation") to the value of certain of the reporting units that was intended to adjust the value of the relevant reporting unit to compensate for certain inter-company purchases. The award allocation was calculated based on certain sales by the relevant reporting unit and, for each reporting unit that received an award allocation, resulted in a higher calculated fair value. The Firm failed to test the underlying data and the calculation of the award allocation. The Firm also failed to assess whether the methodology was applied consistently from year to year and whether the incorporation of the award allocation into the analysis was appropriate. The issuer's impairment analysis indicated that, without this award allocation, the issuer would have been required by GAAP to perform the second step of the goodwill impairment test to determine the amount of impairment, if any, for approximately one quarter of the issuer's reporting units.

Answer the following questions by completing the first four steps of the framework for professional decision making introduced in Chapter:

a. What difficulties might the auditor have faced when deciding whether Issuer A's approach was reasonable? Why might the audit firm have not appropriately tested Issuer A's analysis?

b. What are the consequences of the auditor's decisions in this case?

c. What are the risks and uncertainties associated with the client's analysis?

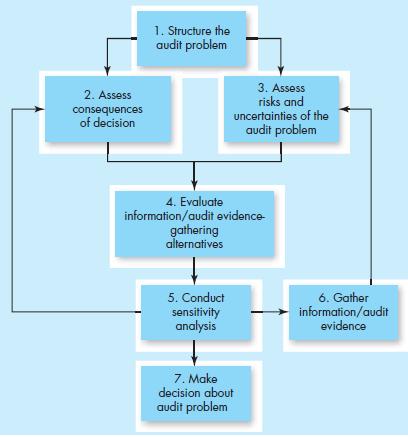

d. What types of evidence should the auditor gather to evaluate the reasonableness of management's approach? Recall that the framework is as follows:

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... GAAP

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Step by Step Answer:

Auditing a risk based approach to conducting a quality audit

ISBN: 978-1133939153

9th edition

Authors: Karla Johnstone, Audrey Gramling, Larry Rittenberg