In the following table, General Electrics Balance Sheet from its 2005 annual report is shown. There are

Question:

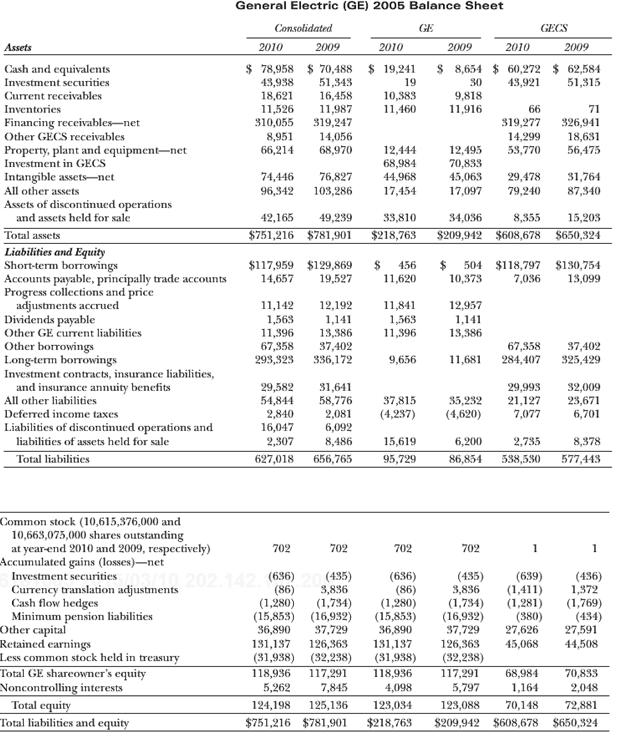

In the following table, General Electric’s Balance Sheet from its 2005 annual report is shown. There are six columns of numbers. In the first two columns, GE’s consolidated balance sheets for 2010 and 2009, respectively, are reported. The middle set of columns (listed under GE) represents GE’s unconsolidated balance sheet, which treats all controlled subsidiaries as investments. Finally, the last two columns, listed under GECS (General Electric Credit Services), represent the balance sheet for GE’s 100% owned subsidiary, GECS.

Required:

A. Examine the middle set of columns showing GE’s unconsolidated numbers. GE reports $68,984 as the investment in GECS. Which method does GE use to account for this investment, cost or equity method? Explain your answer.

B. Compare the consolidated totals for assets, liabilities, and equity to the totals for GE’s numbers unconsolidated. Which totals are different between the consolidated and the unconsolidated numbers? Explain why some numbers are the same when consolidated and why some numbers are different.

C. The noncontrolling interest reported for 2010 on the consolidated statement is $5,262. Is any of this related to GECS? Explain your answer. Under the new exposure drafts, predict whether minority interest will increase, decrease, or stay the same (keep in mind that GE has a large amount of goodwill reported in intangible assets).

D. In addition to reporting the consolidated numbers, GE also reports separate information on GE and GECS. What do we learn from this increased disclosure beyond what we might learn if only the consolidated numbers were reported? Suppose that GE reported on

GECS using the equity method and did not consolidate the subsidiary. Would this be misleading to the users of the financial statements? Why, or why not?

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Intangible Assets

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: