Integrate and reconcile all overhead variances. (Continuation of 8-46). In exercise 8-46 FlatScreen manufactures flat-panel LCDdisplays. The

Question:

Integrate and reconcile all overhead variances. (Continuation of 8-46).

In exercise 8-46

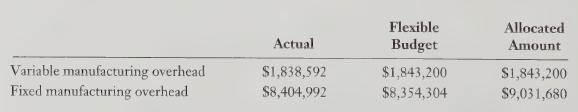

FlatScreen manufactures flat-panel LCDdisplays. The displays are sold to major PC manufacturers. Following are some manufacturingoverhead data for FlatScreen for the year ended December 31, 2013:

FlatScreen's budget was based on the assumption that 17,760 units (panels) will be manufactured during 2013. The planned allocation rate was two machine-hours per unit. FlatScreen uses machine-hours as the cost driver. Actual number of machine-hours used during 2013 was 36,480. The budgeted variable manufacturing overhead costs equal $1,704,960.

REQUIRED

1. Prepare appropriate journal entries for variable and fixed manufacturing overhead (you will need to calculate the different variances to accomplish this).

2. Overhead variances may be used to reconcile the Cost of Goods Sold account at the end of the fiscal year. Cost of goods sold (COGS) is then entered on the income statement. Show how COGS is reconciled through journal entries.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133392883

6th Canadian edition

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ