Interpreting profitability and risk ratios GlaxoSmithKline plc is a pharmaceutical company headquartered in the United Kingdom. Exhibit

Question:

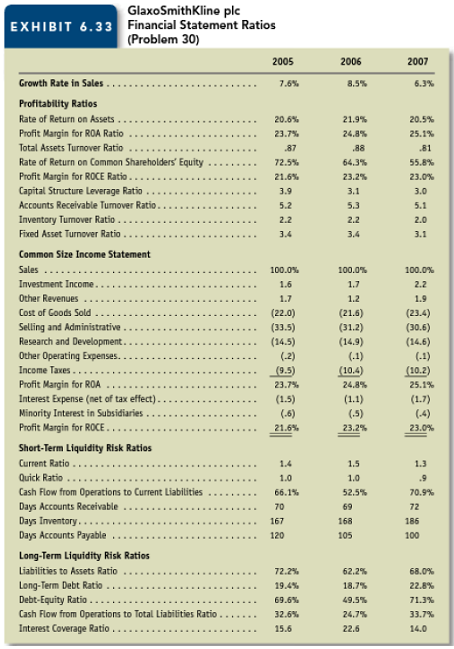

Interpreting profitability and risk ratios GlaxoSmithKline plc is a pharmaceutical company headquartered in the United Kingdom. Exhibit 6.33 presents financial statement ratios for GlaxoSmithKline for 2005, 2006, and 2007. Ignore the Line for Minority Interest in Subsidiaries, an account that Chapter 13 discusses Respond to each of the following question

a. What are the likely reasons for the increase in the profit margin for ROA during the three-year period from 2005 to 2007?

b. What are the Likely reasons for the decrease in the total asset turnover from .88 in 2006 to .81 in 2007?

c. Did financial leverage work to the advantage of the common shareholders in 2007? Explain in such a way that indicates your understanding of the concept of financial leverage.

d. What are the likely reasons for the decrease in the current ratio from 1.5 in 2006 to 1.3 in 2007?

e. What are the likely reasons for the pattern of changes in the two cash flow ratios during the three-year period from 2005 to 2007?

Step by Step Answer:

Financial Accounting an introduction to concepts, methods and uses

ISBN: 978-0324789003

13th Edition

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis