It is the not-too-distant future and all important human needs have been eliminated. Thanks to the firm

Question:

It is the not-too-distant future and all important human needs have been eliminated. Thanks to the firm Bioeconotek, a miracle drug, Needless, has been invented that genetically suppresses a patient’s desire to think in terms of having needs. The drug stimulates the patient’s cognitive ability to perceive substitute products as being ever more attractive the greater the price of any item. Needless does not come cheap. Given its curative powers, Bioeconotek charges $ 1,633 per dose and sells 62,020,000 doses annually despite the presence of a competitive fringe of generic suppliers, which collectively sell 51,650,000 doses annually at the same $ 1,633 price. Bioeconotek managers estimate that the fringe supply curve is described by the equation:

P = 600 + QFS / 50,000.

and that the market demand is given by:

P = 13,000 – QM / 10,000.

In the preceding equations P is the price per dose, Q FS is the quantity supplied by the competitive fringe, and Q M is the quantity consumed in the total market. The marginal cost associated with producing and distributing Needless is a constant $ 600 per dose. Bioeconotek initially invested $ 400 million in developing the drug but has faced no additional fixed costs since the initial investment.

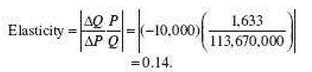

a. At the current price of $ 1,633, a Bioeconotek manager estimates the demand elasticity for Needless as:

Since this value represents an inelastic demand, he argues that Needless’s price should be raised. Is there something wrong with this reasoning? Briefly explain.

b. Write an equation that gives the demand for Bioeconotek’s own output—that is, demand as seen by Bioeconotek given market demand and the fringe supply.

c. What is the profit-maximizing price for Bioeconotek to charge, given the current market demand and the current fringe supply? (Recall that if a demand curve can be written as P = a – bQ, then MR = a – 2bQ.)

d. If Bioeconotek wants to implement a “limit-pricing” strategy that successfully eliminates fringe suppliers from the market, what annual output level does it need to select for its own product, Needless?

e. Another Bioeconotek manager worries about future growth of the fringe supply and argues that the company should set the price determined in part d so as to drive the current fringe out of business and eliminate any incentives for further entry. As briefly as possible, explain why this strategy cannot be more profitable than the pricing strategy you gave in part c.

Step by Step Answer:

Microeconomics Theory and Applications

ISBN: 978-1118758878

12th edition

Authors: Edgar K. Browning, Mark A. Zupan