John Williams (age 42) is a single taxpayer, and he lives at 1324 Forest Dr., Reno, NV

Question:

John Williams (age 42) is a single taxpayer, and he lives at 1324 Forest Dr., Reno, NV 89501. His Social Security number is 555949358. John’s earnings and withholdings as the manager of a local casino for 2014 are:

Earnings from the Lucky Ace Casino………………………………. $195,000

Federal income tax withheld……………………………………….. 32,000

State income tax withheld………………………………………….. 0

John’s other income includes interest on a savings account at Nevada National Bank of $13,075.

John pays his ex wife $4,000 per month. When their 12yearold child (in the wife’s custody) reaches 18, the payments are reduced to $2,800 per month. His ex wife’s Social Security number is 554445555.

During the year, John paid the following amounts (all of which can be substantiated):

Credit card interest……………………………………………… 1,760

Auto loan interest……………………………………………….. 4,300

Auto insurance…………………………………………………… 900

Property taxes on personal residence……………………………. 6,200

Blue Cross health insurance premiums…………………………... 1,800

Other medical expenses………………………………………….. 790

Income tax preparation fee………………………………………. 900

Charitable contributions:

Boy Scouts………………………………………………………. 800

St. Matthews Church……………………………………………. 300

U. of Nevada (Reno) Medical School…………………………... 30,000

Nevada Democratic Party……………………………………….. 250

Fundraising dinner for the Reno Auto Museum………………… 100

(value of dinner is $50)

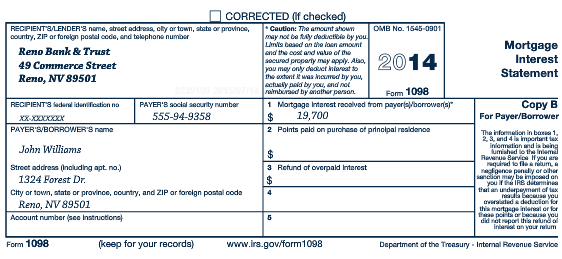

John also received the following Form 1098:

Required:

Complete John’s federal tax return for 2014. Use Form 1040, Schedule A, and Schedule B, from Pages 551 through 554 to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2015

ISBN: 9781305177772

33rd Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven Gill