Joon manufactures and sells to retailers a variety of home care and personal care products. Joon has

Question:

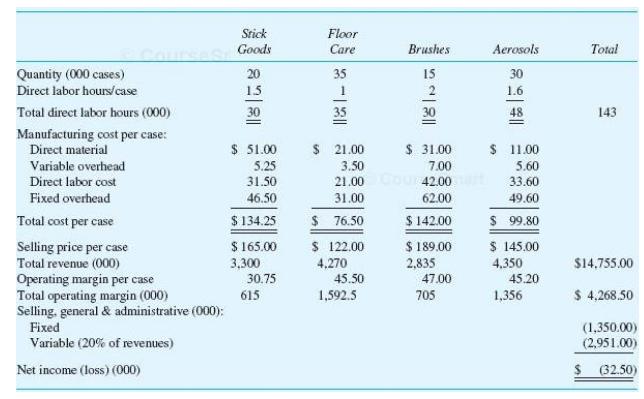

Joon manufactures and sells to retailers a variety of home care and personal care products. Joon has a single plant that produces all four of its product lines: Stick Goods (brooms and mops), Floor Care ( strippers, soaps, and waxes), Brushes ( hair brushes and shoe brushes), and Aerosols ( room deodorizers, bug spray, furniture wax). The following statement summarizes Joon’s financial performance for the most recent fiscal year.

Direct labor costs $ 21 per hour. Fixed manufacturing overhead of $ 4.433 million is allocated to products based on direct labor hours. Last year, the fixed manufacturing overhead rate was $ 31 per direct labor hour ($ 4.433 million/ 143,000 direct labor hours). Variable manufacturing overhead is $ 3.50 per direct labor hour. Selling, general, and administrative ( SG& A) expenses consist of fixed costs ($ 1.35 million) and variable costs ($ 2,951 million). The variable SG& A is 20 percent of revenues.

The Joon plant has considerable excess capacity. Senior management has identified a potential acquisition target, Snuffy, that sells a line of automotive products ( car waxes, soaps, brushes, and so forth) that are complementary to Joon’s existing products and that can be manufactured in Joon’s plant. Snuffy does not have any manufacturing facilities, but rather outsources the production of its products to contract manufacturers. Snuffy can be purchased for $ 38 million. The following table summarizes Snuffy’s current operating data:

Senior management argues that the reason Joon is currently losing money is that volumes have fallen in the plant and that the remaining products are having to carry an increasingly larger share of the overhead. This has caused some Joon product managers to raise prices. Senior managers realize that they must drive more volume into the plant if Joon is to return to profitability. Since organic growth (i. e., growth from existing products) is difficult due to a very competitive marketplace, management proposes to the board of directors the purchase of Snuffy as a way to drive additional volume into the plant. With volume of 60,000 cases and 1.9 direct labor hours per case, Snuffy’s car care product line will add 114,000 direct labor hours to the plant and increase volume about 80 percent (114,000/ 143,000). This additional volume will significantly reduce the overhead the existing products must absorb and allow the product managers to lower prices. To incorporate Snuffy’s manufacturing and distribution into Joon’s current operations, Joon will have to incur additional fixed manufacturing overhead of $ 450,000 per year for new equipment, and $ 400,000 per year for additional SG& A expenses.

Required:

a. Prepare a pro forma financial statement that shows Joon’s financial performance ( net in-come) for the most recent fiscal year assuming that Joon has already acquired Snuffy’s car care products and has incorporated them into Joon’s manufacturing and SG& A processes. In preparing your analysis, make the following assumptions:

(i) Snuffy’s products have the same fixed and variable cost structure as Joon’s exisiting lines ( i. e., variable overhead is $ 3.50 per direct labor hour and variable SG& A is 20 percent of revenues).

(ii) The addition of Snuffy products does not change the demand for Joon’s existing products.

(ii) There are no positive or negative externalities in manufacturing from having the additional Snuffy volume in the plant.

(iv) There is sufficient excess capacity in the plant and the local labor markets to absorb the additional Snuffy volume without causing labor rates or raw material prices to rise.

b. Based on your financial analysis in part (a), should Joon acquire Snuffy?

c. Evaluate management’s arguments in favor of acquiring Snuffy.

d. What other advice would you offer Joon’s management?

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman