Jordyn Insurance Agency is negotiating for the acquisition of computer equipment from Prometheus Industries effective 1/1/XXXX. Jordyn

Question:

Jordyn Insurance Agency is negotiating for the acquisition of computer equipment from Prometheus Industries effective 1/1/XXXX. Jordyn Insurance Agency has asked for your assistance in evaluating the available financing alternatives. One alternative is to purchase the equipment outright for a unit purchase price (UPP) of $120,000 plus 5 percent sales tax, plus destination, unpacking, and installation charges estimated at $2,000. The estimated useful life of the equipment is five years, at the end of which the salvage value is estimated at $8,000. If Jordyn Insurance Agency purchases the equipment, it will use straight-line depreciation over a five- year life for tax purposes (instead of the MACRS method). Its marginal income tax rate is 40 percent. For simplicity, assume that the UPP and other out-of-pocket costs will come from existing working capital.

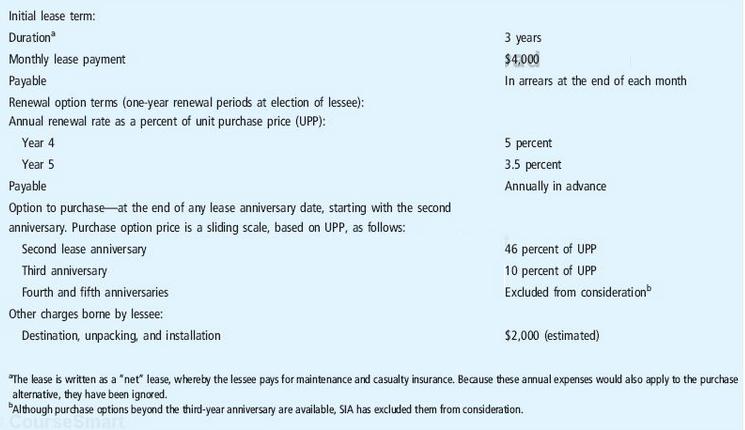

Leasing the equipment through the financing subsidiary of Prometheus Industries is another possibility. The key provisions of the lease arrangements include those shown in Exhibit 17.4.

Show the details of each alternative in two columns: one column for nominal dollars and one for discounted amounts. Use a before- tax discount factor of 12 percent.

- Outright purchase

- Lease, with exercise of option to purchase at the end of year 2

- Lease, with exercise of option to purchase at the end of year 3

- Lease, with renewal at the end of year 3 and another renewal at the end of year 4

Whenever income tax calculations are required, assume that the cash savings from income taxes occurs at the end of the year in which the tax deduction occurs.

Personal property taxes are paid at the end of each year by the title holder. The tax rate is $50 per $1,000 of “value.” For alternatives b and c, as in the case of the purchase alternative, assume that the option purchase price will come from existing working capital. Also, for cost and personal property tax purposes, consider that the option purchase price is subject to a 5 percent sales tax. Obtain hard-copy printouts of both the results of the calculations and the spreadsheet formulas.

Required:

Use spreadsheet software to prepare a comparative analysis of the following financing alternatives, using an approach based on discounted cash flows.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Accounting Information Systems

ISBN: 978-1133935940

10th edition

Authors: Ulric J. Gelinas, Richard B. Dull