Julia Vanfleet is professor of mathematics. She has received a $225,000 inheritance from her fathers estate, and

Question:

Julia Vanfleet is professor of mathematics. She has received a $225,000 inheritance from her father’s estate, and she is anxious to invest it between now and the time she retires in 12 years. Professor Vanfleet is considering two alternatives for investing her inheritance.

Alternative 1.

Corporate bonds can be purchased that mature in 12 years and that bear interest at 10%. This interest would be taxable and paid annually.

Alternative 2.

A small retail business is available for sale that can be purchased for $225,000. The following information relates to this alternative:

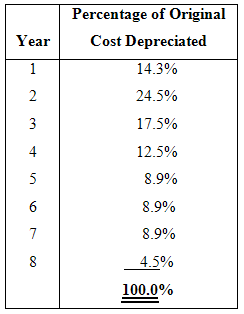

(a) Of the purchase price, $80,000 would be for fixtures and other depreciable items. The remainder would be for the company’s working capital (inventory, accounts receivable, and cash). The fixtures and other depreciable items would have a remaining useful life of at least 12 years but would be depreciated for tax reporting purposes over eight years using the following allowances published by the Internal Revenue Service:

Salvage value is not taken into account when computing depreciation for tax purposes. At any rate, at the end of 12 years these depreciable items would have a negligible Salvage value; however, the working capital would be recovered (either through sale or liquidation of the business) for reinvestment elsewhere.

(b) The store building would be leased. At the end of 12 years, if Professor Vanfleet could not find someone to buy the business, it would be necessary to pay $2,000 to the owner of the building to break the lease.

(c) Store records indicate that sales have averaged $850,000 per year and out-of-pocket costs (including wages and rent on the building) have averaged $780,000 per year (not including income taxes). Management of the store would be entrusted to employees.

(d) Professor Vanfleet’s tax rate is 40%.

Required:

Advise Professor Vanfleet as to which alternative should be selected. Use the total-cost approach to net present value in your analysis, and a discount rate of 8%. Round all dollars amounts to the nearest whole dollar.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer