Kamin Corp., completed the following transactions in 2016: Jan 1 Purchased a building costing $150000 and signed

Question:

Kamin Corp., completed the following transactions in 2016:

Jan 1 Purchased a building costing $150000 and signed an 12%. 15-year mortgage note payable for the same amount.

Jun 30 Made the first semiannual payment on the mortgage note payable.

Dec 1 Signed a five-year lease to rent a warehouse for $10.000 per month due at the end of each month. The lease is considered an operating lease.

31 Paid for one month's rent on the warehouse.

31 Leased 10 copiers and signed a four-year lease with the option to buy the copiers at the end of the fourth year at a bargain price. Under terms of the lease, monthly lease payments do not start until January 31. 2018. The present value of the lease payments is $31 .000.

31 Made the second semiannual payment on the mortgage note payable

Requirements

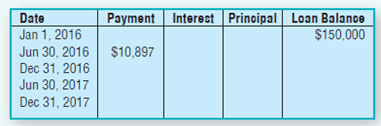

1. Complete the following amortization schedule for the first four mortgage payments on the $150,000 mortgage note, assuming semiannual payments of $10,897. Round amounts to the nearest dollar.

2. Record the journal entries for the 2016 transactions.

3. Prepare the long-term liabilities section of the balance sheet on December 31, 2016?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: