Kellogg Company in its 2004 Annual Report in Note 1??Accounting Policies made the comment on page 962

Question:

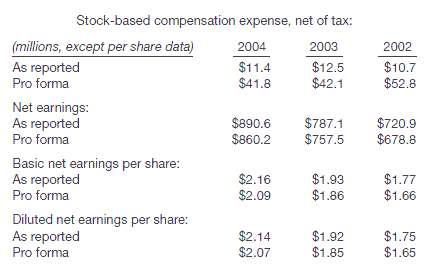

Kellogg Company in its 2004 Annual Report in Note 1??Accounting Policies made the comment on page 962 about its accounting for employee stock options and other stock-based compensation. This was the annual report issued the year before the FASB mandated expensing stock options.Stock compensation (in part) The Company currently uses the intrinsic value method prescribed by Accounting Principles Board Opinion (APB) No. 25, ??Accounting for Stock Issued to Employees,?? to account for its employee stock options and other stock-based compensation. Under this method, because the exercise price of the Company??s employee stock options equals the market price of the underlying stock on the date of the grant, no compensation expense is recognized. The following table presents the pro forma results for the current and prior years, as if the Company had used the alternate fair value method of accounting for stockbased compensation, prescribed by SFAS No. 123, ??Accounting for Stock-Based Compensation?? (as amended by SFAS No. 148).

Under this pro forma method, the fair value of each option grant (net of estimated unvested forfeitures) was estimated at the date of grant using an option-pricing model and was recognized over the vesting period, generally two years. Refer to Note 8 for further information on the Company??s stock compensation programs. In December 2004, the FASB issued SFAS No. 123(Revised), ??Share-Based Payment,?? which generally requires public companies to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value and to recognize this cost over the requisite service period. The Company plans to adopt SFAS No. 123(Revised), as of the beginning of its 2005 fiscal third quarter and is currently considering retrospective restatement to the beginning of its 2005 fiscal year. Once this standard is adopted, management believes full-year fiscal 2005 net earnings per share will be reduced by approximately $.08.Instructions(a) Briefly discuss how Kellogg??s financial statements were affected by the adoption of the new standard.(b) Some companies argued that the recognition provisions of the standard are not needed because the computation of earnings per share takes into account dilutive securities such as stock options. Do you agree? Explain, using the Kellogg disclosure providedabove.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: