Kenisha Johnson, CEO of Eastern Electronics Inc., is looking at the possibility of marketing a new product

Question:

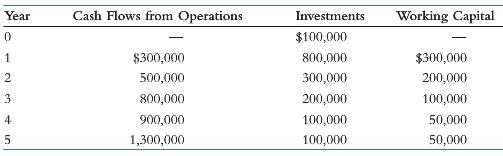

Kenisha Johnson, CEO of Eastern Electronics Inc., is looking at the possibility of marketing a new product line. Kenisha will be approaching a risk capital investor, Manon Miller, asking for $500,000 in equity participation. This is 30% of the company’s equity share. When Kenisha had her first meeting with Manon, she presented the following financial projections:

During the conversation, both agreed that 20% should be used as a discount rate to calculate the present value of the company’s cash flows and as a capitalization rate. Manon said that she hoped that at the end of five years, when she would make her exit, the company would be worth at least six times its last year’s cash flows.

1. What is the company’s net present value?

2. What is the company’s internal rate of return using only the five-year projections?

3. What is the company’s present value of the residual value?

4. What is the company’s fair market value?

5. What is Manon Miller’s internal rate of return on her investment?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer: