Killroy Company owns a trade name that was purchased in an acquisition of McClellan Company. The trade

Question:

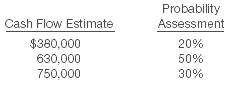

Killroy Company owns a trade name that was purchased in an acquisition of McClellan Company. The trade name has a book value of $3,500,000, but according to GAAP, it is assessed for impairment on an annual basis. To perform this impairment test, Killroy must estimate the fair value of the trade name. (You will learn more about intangible asset impairments in Chapter 12.) It has developed the following cash flow estimates related to the trade name based on internal information. Each cash flow estimate reflects Killroy??s estimate of annual cash flows over the next 8 years. The trade name is assumed to have no residual value after the 8 years. (Assume the cash flows occur at the end of each year.)

Instructions(a) What is the estimated fair value of the trade name? Killroy determines that the appropriate discount rate for this estimation is 8%. Round calculations to the nearest dollar.(b) Is the estimate developed for part (a) a Level 1 or Level 3 fair value estimate?Explain.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer: