Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of

Question:

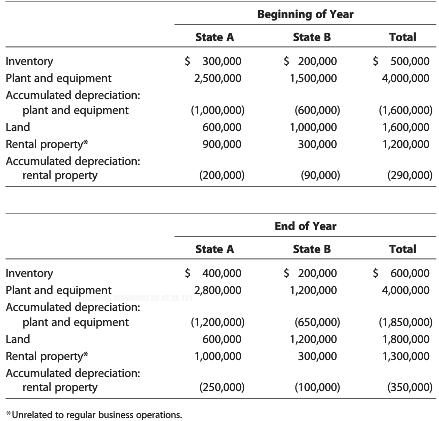

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kim’s property holdings follows.

Determine Kim’s property factors for the two states assuming that the statutes of both A and B provide that average historical cost of business property is to be included in the property factor.

Transcribed Image Text:

Beginning of Year Inventory Plant and equipment Accumulated depreciation: State A $300,000 2,500,000 State B $ 200,000 1,500,000 Total S500,000 4,000,000 plant and equipment Land Rental property* Accumulated depreciation: (1,000,000) 600,000 900,000 (600,000) 1,000,000 300,000 (1,600,000) 1,600,000 1,200,000 rental property (200,000) (90,000) (290,000) End of Year Total 600,000 4,000,000 State A State B S 400,000 2,800,000 S 200,000 Inventory Plant and equipment Accumulated depreciation: 1,200,000 plant and equipment Land Rental property* Accumulated depreciation: (1,200,000) 600,000 1,000,000 (650,000) 1,200,000 300,000 (1,850,000) 1,800,000 1,300,000 rental property (250,000) (100,000) (350,000) *Unrelated to regular business operations.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 41% (12 reviews)

Under the statutes of States A and B accumulated depreciation and nonbusiness pr...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Corporations questions

-

Beige Corporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year. Federal income taxes paid $75,000 Net operating loss...

-

Red Corporation, a calendar year taxpayer, has taxable income of $600,000. Among its transactions for the year are the following: Collection of proceeds from insurance policy on life of corporate...

-

Beebe Corporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year. Federal income taxes paid $75,000 Net operating loss carry...

-

Two thousand kg of water, initially a saturated liquid at 150C, is heated in a closed, rigid tank to a final state where the pressure is 2.5 MPa. Determine the final temperature, in C. the volume of...

-

In questions a through d, indicate whether you would use the table for determining the future value of a single sum ( FVIF ), the present value of a single sum ( PVIF ), the future value of an...

-

Use Eq. (12) to find N at the point indicated.

-

Explain events and their importance in dynamic modeling.

-

Liedtke's advisors suggest that Texaco has more options in the face of Pennzoil's $5 billion counteroffer than simply to refuse or accept. In particular, they might counteroffer, probably with an...

-

The field of project management is extremely complex. To be successful, a project manager must be familiar with a variety of tools, methodologies, and information. The definition of a project's...

-

Tim Markus, Vice President of Phone Lines, earned $92,000 in salary last year. In addition to his salary, he also received low-interest loans from his employer. Tim's interest rate on these loans is...

-

Josie is a sales representative for Talk2Me, a communications retailer based in Fort Smith, Arkansas. Josie's sales territory is Oklahoma, and she regularly takes day trips to Tulsa to meet with...

-

True Corporation, a wholly owned subsidiary of Trumaine Corporation, generated a $400,000 taxable loss in its first year of operations. True's activities and sales are restricted to State A, which...

-

Big Company paid $100,000 at the beginning of the year to a large law firm to retain its services should they be needed during the course of the year. The law firm specializes in real estate law and...

-

How much is Juliana's Ohio deduction for prior-year depreciation add-backs?

-

Both David Jones and Myer department stores use celebrities, such as Megan Gale and Jennifer Hawkins. By advertising their merchandise with women who represent contemporary style and glamour, they...

-

You are recognized as one of the premiere business-to-business (B2B) sales relationship gurus. Given your reputation, you have been asked to be the keynote speaker at an industry luncheon. You will...

-

Describe how Aldi likely used research to gain the new success they have seen in the grocery category in the US. Include in your discussion the topics from Module 3, such as drivers analysis,...

-

Today is June 1. Sustainable Corporation has an obligation of $25 million coming due on August 1. The company is planning to borrow this amount on August 1 to fulfill its obligation, and plans to pay...

-

Jon Conlin, CPA, was an accountant and partner in a large firm. Recently, he resigned his position to open his own accounting business, which he operates as a proprietorship. The following events...

-

Show that the block upper triangular matrix A in Example 5 is invertible if and only if both A 11 and A 22 are invertible. Data from in Example 5 EXAMPLE 5 A matrix of the form A = [ A11 A12 0 A22 is...

-

Pablo has a $63,000 basis in his partnership interest. On May 9 of the current tax year, the partnership distributes to him, in a proportionate nonliquidating distribution, cash of $25,000, cash...

-

Pablo has a $63,000 basis in his partnership interest. On May 9 of the current tax year, the partnership distributes to him, in a proportionate nonliquidating distribution, cash of $25,000, cash...

-

When Brunos basis in his LLC interest is $150,000, he receives cash of $55,000, a proportionate share of inventory, and land in a distribution that liquidates both the LLC and his entire LLC...

-

Pada 1 Januari 2022, Muller Berhad membeli 1,000 unit bon yang disebut pada harga RM925 seunit untuk dagangan dengan tujuan menjana keuntungan daripada turun naik harga jangka pendek. Nilai nominal...

-

Sunlight company needs a machine for its manufacturing process. The cost of the new machine is $80,700. The expected useful life of the machine is 8 years. At the end of 8-year period, the machine...

-

The following are account balances for Bob Smith Co. for the year ended December 31, 2022: Fees earned $170,000 Cash $30,000 Accounts receivable 14,000 Selling expenses 44,000 Equipment 42,000 Sam,...

Study smarter with the SolutionInn App