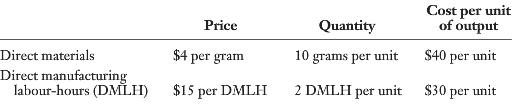

Korna Company manufactures a product, gizmo, that uses the following direct inputs: Korna has no direct materials

Question:

Korna Company manufactures a product, gizmo, that uses the following direct inputs:

Korna has no direct materials inventory. All manufacturing overhead costs are variable costs. The manufacturing overhead cost is comprised of two activities: setup and operations. The cost driver for setup is setup hours, and the cost driver for operations is direct manufacturing labour-hours. Korna allocates setup cost at a rate of $80 per setup-hour, and each setup takes two hours. Korna Company makes gizmos in batches of 100 units. Operations costs are allocated at a rate of $1.60 per direct manufacturing labour-hour.

REQUIRED

1. Korna plans to make and sell 20,000 gizmos in the first quarter of next year. The selling price for the product is $120. Prepare the revenue budget for the first quarter.

2. Prepare the direct material usage budget for the first quarter of next year.

3. Prepare the direct manufacturing labour usage budget for the first quarter of next year.

4. Prepare the manufacturing overhead cost budget for each activity for the first quarter of next year.

5. Compute the budgeted unit cost of a gizmo for the first quarter of next year.

6. Prepare the cost of goods sold budget for the first quarter of next year. Assume Korna budgets 1,000 units of beginning finished goods inventory at a cost of $72 per unit. Korna uses the LIFO cost flow assumption for finished goods inventory. Korna expects to sell all 20,000 gizmos made in the first quarter.

7. Calculate the budgeted gross margin for the first quarter of next year.

8. Korna Company managers want to implement Kaizen costing. They budget a 1% decrease in materials quantity and direct manufacturing labour-hours and a 3% decrease in setup time per unit for each subsequent quarter. Calculate the budgeted unit cost and gross margin for quarters two and three. Assume no change in budgeted output.

9. Refer to requirement 8 above. How could the reduction in materials and time be accomplished? Are there any problems with this plan?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133392883

6th Canadian edition

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ