La Hacienda Company has two departments: Furniture and Lighting. La Haciendas accountant prepares an adjusted trial balance

Question:

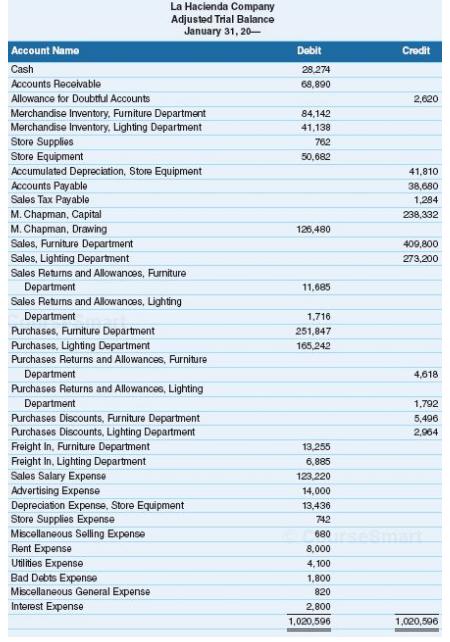

La Hacienda Company has two departments: Furniture and Lighting. La Hacienda’s accountant prepares an adjusted trial balance (shown below) at the end of the fiscal year.

The trial balance is prepared after all adjustments, including the adjustments for merchandise inventory, have been recorded and posted.

Merchandise inventories at the beginning of the year were as follows: Furniture Department, $ 83,850; Lighting Department, $ 42,630. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar):

• Sales Salary Expense (payroll register): Furniture Department, $ 74,800; Lighting Department, $ 48,420

• Advertising Expense (newspaper column inches): Furniture Department, 600 inches; Lighting Department, 400 inches

• Depreciation Expense, Store Equipment (property and equipment ledger): Furniture Department, $ 9,616; Lighting Department, $ 3,820

• Store Supplies Expense (requisitions): Furniture Department, $ 418; Lighting Department, $ 324

• Miscellaneous Selling Expense (volume of gross sales): Furniture Department, $ 408; Lighting Department, $ 272

• Rent Expense and Utilities Expense (floor space): Furniture Department, 2,500 square feet; Lighting Department, 1,500 square feet

• Bad Debts Expense (volume of gross sales): Furniture Department, $ 1,080; Lighting Department, $ 720

• Miscellaneous General Expense (volume of gross sales): Furniture Department, $ 492; Lighting Department, $ 328

Required

Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.

Step by Step Answer:

College Accounting

ISBN: 978-1111528126

11th edition

Authors: Tracie Nobles, Cathy Scott, Douglas McQuaig, Patricia Bille