Lai Inc. had the following investment transactions: 1. Purchased Chang Corporation preferred shares as a trading investment

Question:

Lai Inc. had the following investment transactions:

1. Purchased Chang Corporation preferred shares as a trading investment and accounts for them using the fair value through profit or loss model.

2. Received a cash dividend on the Chang preferred shares.

3. Purchased Government of Canada bonds for cash, intending to hold them until maturity and account for them using the amortized cost model.

4. Accrued interest on the Government of Canada bonds.

5. Sold half of the Chang preferred shares at a price less than originally paid.

6. On the first day of the year, purchased 25% of Xing Ltd.'s common shares, which was enough to achieve significant influence and account for the investment using the equity method.

7. Received Xing's financial statements, which reported a net loss for the year.

8. Received a cash dividend from Xing.

9. The fair value of Chang's preferred shares was lower than cost at year end.

10. The fair value of the Government of Canada bonds was higher than amortized cost at year end and the fair value of Xing Ltd.'s common shares is unknown?

Instructions

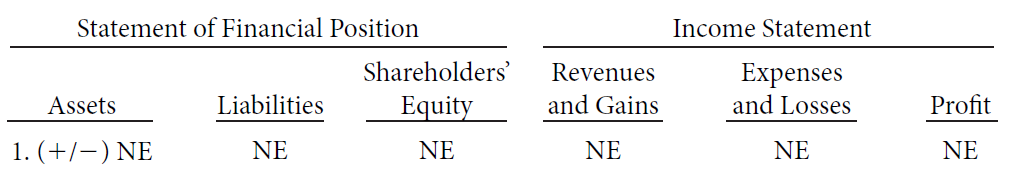

(a) Using the following table format, indicate whether each of the above transactions would result in an increase (1), a decrease (2), or have no effect (NE) on the specific element in the statement. The first one has been done for you as an example.

(b) If the company were reporting under IFRS, would any alternative(s) to the models chosen be allowed? Explain.

(c) If the company were reporting under ASPE, would any alternative(s) to the models that were initially chosen be allowed? Explain.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1118644942

6th Canadian edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine