Lambert Corporation issued 1,000 shares of $100 par value, 8 percent, cumulative, nonparticipating preferred stock for $100

Question:

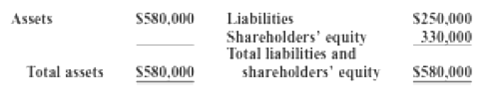

Lambert Corporation issued 1,000 shares of $100 par value, 8 percent, cumulative, nonparticipating preferred stock for $100 each. The stock is preferred to assets, redeemable after five years at a prespecified price, and the preferred shareholders do not vote at the annual shareholders' meeting. The condensed balance sheet of Lambert prior to the issuance follows:

Lambert ahs entered into a debt agreement that requires the company to maintain a debt/equity ratio of less than 1:1.

Required

(a) Provide the journal entry to record the preferred stock issuance, and compute the resulting debt/equity ratio, assuming that the preferred stock is considered an equity security.

(b) Compute the debt/equity ratio, assuming that the preferred stock is considered a debt security.

(c) What incentives might the management of Lambert have to classify the issuance as equity instead of debt? Do you think that the issuance should be classified as debt or equity? What might Lamberts external auditors think?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer: