Lander Corporation owns 35 percent of the voting stock of Windson Corporation. The balance of the Investment

Question:

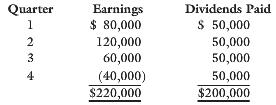

Lander Corporation owns 35 percent of the voting stock of Windson Corporation. The balance of the Investment account on Lander’s books as of January 1, 2011, was $360,000. During 2011, Windson reported the following quarterly earnings and dividends:

Because of the percentage of voting shares Lander owns, it can exercise significant influence over the operations of Windson. Therefore, Lander must account for the investment using the equity method.

REQUIRED

1. Prepare a T account for Lander’s investment in Windson and enter the beginning balance, the relevant transactions for the year in total, and the ending balance.

2. What is the effect and placement of the transactions in 1 on Lander’s earnings as reported on the income statement?

3. What is the effect and placement of the transactions in 1 on the statement of cash flows?

4. How would the effects on the statements differ if Lander’s ownership represented only a 15 percent share of Windson?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer: