Last year CB Medical Technologies (CB) introduced a proprietary orthopedic surgical saw that is used in a

Question:

Last year CB Medical Technologies (CB) introduced a proprietary orthopedic surgical saw that is used in a variety of orthopedic applications. However, its largest demand is in hip replacement surgeries. The electric reciprocating saw’s patented technology (including the blade) reduces noise and vibration and increases precision cutting, thereby reducing postoperative complications. CB manufactures and sells both the saw and blades. CB blades are designed and engineered specifically for the CB saw, and CB saws are designed to only be used with CB blades. When an orthopedic surgeon performs a surgery, each blade is dedicated to one particular patient and, once used, the blade is discarded. Surgeons often use two or three blades during surgery on a patient. CB saws sell for $ 2,000 each and CB blades sell for $ 450 per blade.

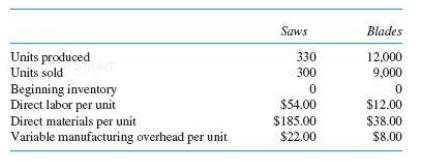

CB manufactures both the saw and blades in the same factory. The following table summarizes the variable and direct costs of the saws and blades and the number of units of each product produced and sold last year.

CB uses an activity- based costing system to assign fixed manufacturing overhead to the saws and blades. There are three fixed manufacturing overhead cost pools in the ABC system: batch costs, product- line engineering costs, and other factory overhead. The following describes the ABC methodology:

• Batch costs ($ 173,000 last year): Batch costs are allocated to the two product lines based on the number of batches manufactured during the year. Saws are produced in batch sizes of 10 saws per batch and blades are manufactured in batch sizes of 500 blades per batch.

• Product- line engineering costs ($ 724,000 last year): Product- line engineering costs are assigned to the two product lines (saws and blades) after a survey of the engineers inquiring how they spent their time. Based on last year’s survey, $ 289,000 was assigned to saws and $ 435,000 was assigned to blades.

• Other factory overhead ($ 330,000): Other factory overhead consists of all other fixed manufacturing overhead not included in either batch costs or product- line engineering costs. These costs are allocated to the saws and blades based on direct labor cost.

Required:

a. Compute CB’s unit manufacturing costs and operating margins (revenues less cost of goods sold) for last year for the saws and blades using the activity- based costing methodology described above.

b. Having seen the ABC income statements prepared in part ( a ), CB management wants to see how the operating margins ( revenues less cost of goods sold) for the saws and blades would look if traditional absorption costing is used where the total fixed factory overhead is allocated to the saws and blades using direct labor dollars.

c. Make a recommendation to management as to whether ABC ( part a ) or traditional absorption costing ( part b ) should be used. Justify your recommendation.

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman