LIFO Effect The following example was provided to encourage the use of the LIFO method. In a

Question:

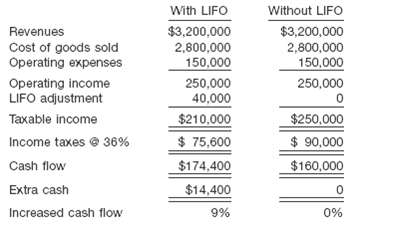

LIFO Effect The following example was provided to encourage the use of the LIFO method. In a nutshell, LIFO subtracts inflation from inventory costs, deducts it from taxable income, and records it in a LIFO reserve account on the books. The LIFO benefit grows as inflation widens the gap between current-year and past-year (minus inflation) inventory costs. This gap is:

(a) Explain what is meant by the LIFO reserve account.

(b) How does LIFO subtract inflation from inventory costs?

(c) Explain how the cash flow of $174,400 in this example was computed. Explain why this amount may not be correct.

(d) Why does a company that uses LIFO have extra cash? Explain whether this situation will alwaysexist.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield