Ling and Morwong are small family-owned companies engaged in vegetable growing and distribution. The Spencer family owns

Question:

Ling and Morwong are small family-owned companies engaged in vegetable growing and distribution. The

Spencer family owns the shares in Morwong and the Rokocoko family owns the shares in Ling. The head of the

Spencer family wishes to retire but his two sons are not interested in carrying on the family business. Accordingly, on

July 1, 2013, Ling is to take over the operations of Morwong, which will then liquidate. Ling is asset-rich but has limited overdraft facilities so the following arrangement has been made.

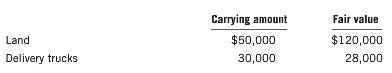

Ling is to acquire all of the assets, except cash, delivery trucks, and motor vehicles, of Morwong and will assume all of the liabilities except accounts payable. In return, Ling is to give the shareholders of Morwong a block of vacant land, two delivery vehicles, and sufï¬cient additional cash to enable the company to pay off the accounts payable and the liquidation costs of $1,500. The land and vehicles had the following values at June 30, 2013:

On the liquidation of Morwong, Mr. Spencer is to receive the land and the motor vehicles and his two sons are to receive the delivery trucks.

The statements of ï¬nancial position of the two companies as at June 30, 2013, were as follows:

-2.png)

All the assets of Morwong are recorded at fair value, with the exception of:

Fair value

Land.......... $120,000

Buildings.......... 40,000

Cultivation equipment..... 40,000

Motor vehicle........ 34,000

Required

(a) Prepare the acquisition analysis and the journal entries to record the acquisition of Morwong€™s operations in the records of Ling.

(b) Prepare the journal entries to record the liquidation of Morwong.

(c) Prepare the statement of ï¬nancial position of Ling after the business combination, including any notes relating to the business combination.

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer: