Linton Industries borrowed $500,000 from Security Bankers to finance the purchase of equipment costing $360,000 and to

Question:

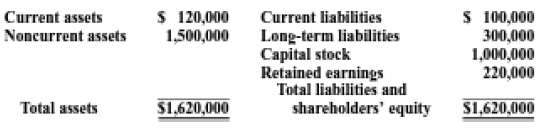

Linton Industries borrowed $500,000 from Security Bankers to finance the purchase of equipment costing $360,000 and to provide $140,000 in cash. The note states that the loan matures in twenty years, and the principal is to be paid in annual installments of $25,000. The terms of the loan also indicate that Linton must maintain a current ratio of 2:1 and cannot pay dividends that will reduce retained earnings below $200,000. The balance sheet of Linton, immediately prior to the bank loan and the purchase of equipment follows:

REQUIRED:The board of directors of Linton is about to declare a dividend to be paid to the shareholders early next year. After accepting the loan and purchasing the equipment, how Large a dividend can the board pay and not violate the terms of the debt covenant?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: