Malone Company determined its ending inventory at cost and at lower-of-cost-or-market at December 31, 2011, December 31,

Question:

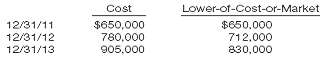

Malone Company determined its ending inventory at cost and at lower-of-cost-or-market at December 31, 2011, December 31, 2012, and December 31, 2013, as shown below.

ending inventory at cost and at">

ending inventory at cost and at">Instructions(a) Prepare the journal entries required at December 31, 2012, and at December 31, 2013, assuming that a perpetual inventory system and the cost-of-goods-sold method of adjusting to lower-of-cost-or-market is used.(b) Prepare the journal entries required at December 31, 2012, and at December 31, 2013, assuming that a perpetual inventory is recorded at cost and reduced to lower-of-cost-or-market using the lossmethod.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: