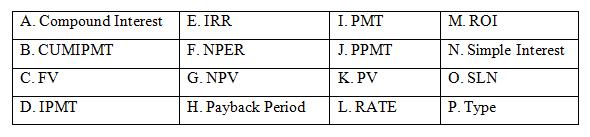

Match the information below 1. Function to calculate value of the end of a financial transaction 2.

Question:

1. Function to calculate value of the end of a financial transaction

1. Function to calculate value of the end of a financial transaction2. Function to calculate the interest percentage per period of a financial transaction

3. Function to calculate the value at the beginning of a financial transaction

4. Function to calculate the number of compounding periods in a financial transaction

5. Function to calculate periodic payments in or out of a financial transaction

6. Use a 0 for this argument to indicate that interest will be paid at the end of each compounding period

7. This type of interest is calculated based on original principal regardless of the previous interest earned

8. This type of interest is calculated based on principal and previous interest earned

9. Function to calculate straight line depreciation based on the initial capital investment, number of years to be depreciated, and salvage value

10. Function to calculate the cumulative interest paid between two periods

11. Function to calculate the amount of a periodic payment that is interest in a given period

12. Function to calculate the amount of a specific periodic payment that is principal in a given period

13. Function that determines the value of a variable set of cash flows discounted to its present value

14. Function that determines the rate of return where the net present value of the cash flows is 0 Net Present Value

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Compound Interest

Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. Thought to have originated in 17th century Italy, compound... Compounding

Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. This growth, calculated using exponential functions, occurs because the investment will... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Succeeding in Business with Microsoft Excel 2013 A Problem Solving Approach

ISBN: 978-1285715346

1st edition

Authors: Debra Gross, Frank Akaiwa, Karleen Nordquist

Question Posted: