Max Corporation has a wholly owned subsidiary, Min Ltd., which was formed several years ago. Both Max

Question:

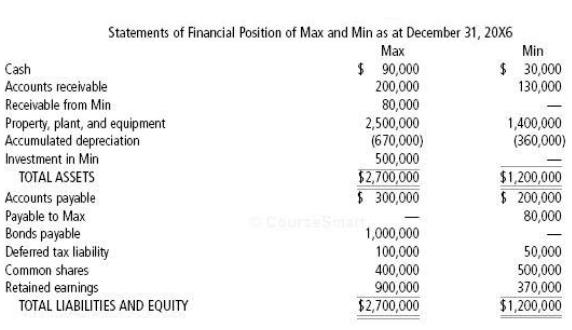

Max Corporation has a wholly owned subsidiary, Min Ltd., which was formed several years ago. Both Max and Min are in the same business, but in different geographic areas. Min’s initial capital was provided by Max, which purchased all of Min’s shares for $ 500,000. At December 31, 20X6, the SFP accounts of Max and Min appeared as follows:

During 20X6, Min paid dividends of $ 80,000 to Max, and purchased goods from Max at a total price of $ 1,200,000. All of the purchases from Max were subsequently sold to third parties during the year.

Required

Prepare a consolidated SFP for Max Corporation at December 31, 20X6.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay

Question Posted: