McIntosh Investments Ltd. (MIL) is a diversified public company. Loraine McIntosh, the president, owns 40% of the

Question:

McIntosh Investments Ltd. (MIL) is a diversified public company. Loraine McIntosh, the president, owns 40% of the common shares of MIL. Another 30% are owned jointly by Loraine’s brothers, Blair and Bill. The 70% ownership by Loraine and her brothers gives her control of the company. The remaining 30% of the shares are widely distributed.

On April 1, 20X6, the first day of MIL’s fiscal year, Loraine succeeded in negotiating the acquisition by MIL of 30% of the outstanding common shares of Efrim Auto Parts, Inc. (EAPI). EAPI was an important supplier of parts to Candide Cars Corporation (CCC), a maker of specialty automobiles (“the best of all possible cars”), which was 40% owned by MIL. Loraine was particularly pleased at being able to arrange the purchase of the shares of EAPI because she was certain that great efficiency could be obtained by having the operations of EAPI and CCC more closely coordinated.

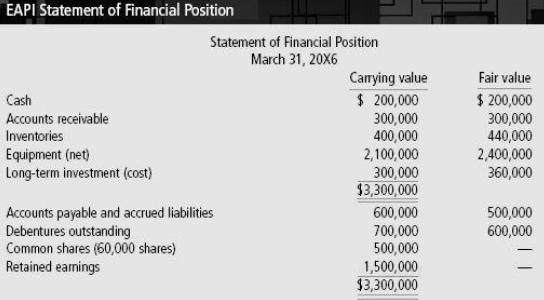

The EAPI shares were purchased from a descendant of the founder of EAPI, Jeffrey Efrim. The shares were purchased for a consideration of $ 600,000 cash and the issuance of 10,000 shares of MIL common stock. MIL shares were currently being traded on the TSX at $ 40 per share. Exhibit A presents the SFP of EAPI as of March 31, 20X6, the end of EAPI’s fiscal year.

During the following year, Loraine and her fellow managers took an active interest in the affairs of both CCC and EAPI. CCC became EAPI’s major customer, and purchased $ 2,000,000 of parts from EAPI during fiscal 20X7. At the end of fiscal 20X7, CCC had

Parts in inventory that were purchased from EAPI at a cost (to CCC) of $ 300,000, as compared to only $ 100,000 as compared to only $100,000 of such parts in inventory a year earlier. The attention of MIL management had increased EAPI’s efficiency so that average gross profit on sales rose to 35% in fiscal 20X7. EAPI’s net income after tax in fiscal 20X7 reached a record high of $ 300,000 after tax, enabling EAPI to declare a dividend of $ 1.50 per common share on March 31, 20X7.

Required

Determine what impact MIL’s investment in EAPI shares and EAPI’s fiscal 20X7 activities will have on the financial statements of MIL. Where alternatives are possible, state them and briefly explain the alternatives you chose. State any assumptions that you find it necessary to make.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay