Mirror Inc. is a global telecommunications company based in Canada. Its a world leader in business telecommunications

Question:

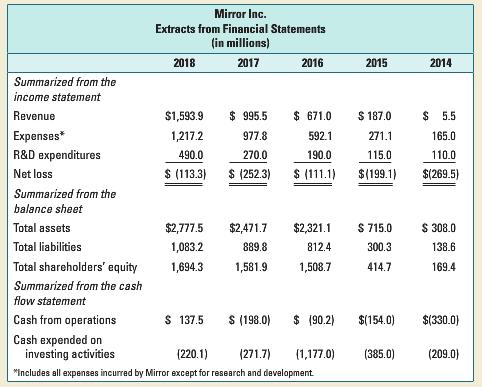

Mirror Inc. is a global telecommunications company based in Canada. It’s a world leader in business telecommunications and is always on the leading edge of new technology. Technology changes rapidly and to maintain its competitive position, Mirror must invest heavily in research and development to ensure it has the next great breakthrough under development. Mirror prepares its financial statements in accordance with IFRS, so it expenses all research costs and any development costs that don’t meet the criteria for capitalization. To date, none of Mirror’s development costs have met the criteria for capitalization. The company has incurred no interest expense. The following information has been summarized from Mirror’s financial statements:

Required:

a. Recalculate net income for 2016 through 2018 assuming that R&D costs were capitalized and expensed over three years using straight-line amortization beginning in 2014.

b. What would total assets be at the end of 2016 through 2018 if R&D costs were capitalized and amortized over three years?

c. What would shareholders' equity be at the end of 2016 through 2018 if R&D costs were capitalized and amortized over three years?

d. What would cash from operations and cash expended on investing activities be if R&D costs were capitalized and amortized over three years?

e. What would the following ratios be assuming that (1) R&D costs were expensed as incurred and (2) R&D costs were capitalized and amortized over three years?

Assume that Mirror didn't have an interest expense over the period 2014-2018.

i. Teturn on assets

ii. Debt-to-equity ratio

iii. Profit margin percentage

f. How would your interpretation of Mirror differ depending on how R&D costs are accounted for? Which accounting approach do you think is more appropriate? Ex plain. Your answer should consider the objectives of the stakeholders and the man agers who prepare the accounting information, as well as the accounting concepts discussed throughout the book.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Stakeholders

A person, group or organization that has interest or concern in an organization. Stakeholders can affect or be affected by the organization's actions, objectives and policies. Some examples of key stakeholders are creditors, directors, employees,...

Step by Step Answer: