Movies Galore distributes DVDs to movie retailers, including online retailers. Movies Galores top management meets monthly to

Question:

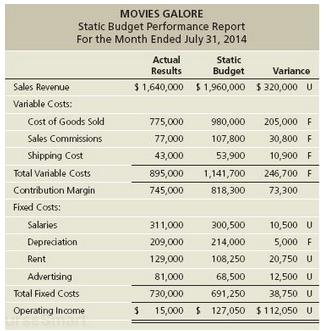

Movies Galore distributes DVDs to movie retailers, including online retailers. Movies Galore’s top management meets monthly to evaluate the company’s performance. Controller Allen Walsh prepared the following performance report for the meeting:

Walsh also revealed that the actual sale price of $ 20 per movie was equal to the budgeted sale price and that there were no changes in inventories for the month. Management is disappointed by the operating income results. CEO Jilinda Robinson exclaims, “How can actual operating income be roughly 12% of the static budget amount when there are so many favorable variances?”

Requirements

1. Prepare a more informative performance report. Be sure to include a flexible budget for the actual number of DVDs bought and sold.

2. As a member of Movies Galore’s management team, which variances would you want investigated? Why?

3. Robinson believes that many consumers are postponing purchases of new movies until after the introduction of a new format for recordable DVD players. In light of this information, how would you rate the company’s performance?

Step by Step Answer:

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura