Multiple Choice Questions 1. Activity-based costing is a method of cost allocation that is useful for assigning

Question:

Multiple Choice Questions

1. Activity-based costing is a method of cost allocation that is useful for assigning ________ costs to products or services.

a. Direct labor

b. Direct material

c. Manufacturing overhead

d. Direct labor and direct material

2. Which of the following statements most accurately describes product-level costs?

a. Product-level costs occur whenever a unit is manufactured.

b. Product-level costs are incurred as necessary to support the production of a product.

c. Product-level costs occur whenever a batch of products is manufactured.

d. Product-level costs are necessary to sustain the overall manufacturing operations.

3. As the proportion of batch-, product-, and facility-level costs increases relative to unit-level costs, the correlation between the overhead allocation and production volume:

a. Becomes more predictable and stable

b. Becomes fixed and positive

c. Becomes less predictable

d. Becomes variable and negative

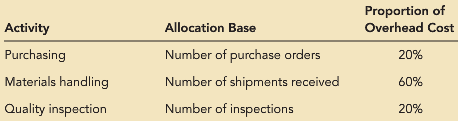

4. Saturation Sprinkler Supply sells sprinkler systems suited for large and small yards. To better estimate costs, the company recently adopted an activity-based costing system. Last year, the company incurred $100,000 in overhead costs. Detailed information about these costs is as follows:

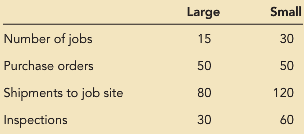

The company also tracked the number of purchase orders, shipments, and inspections consumed by large- and small-yard systems:

If a specific large-yard sprinkler system requires 3 purchase orders, 6 shipments of material, and 2 inspections, how much total overhead cost should be allocated to the job?

a. $722.22

b. $2,222.22

c. $2,844.44

d. none of the above

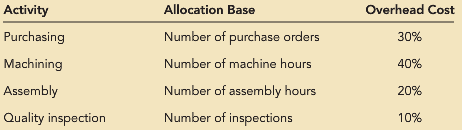

5. The Stanley Corporation sells two versions of its popular gas grills—a regular model and a stainless steel model. To better estimate costs of the two products, the company recently adopted an activity-based costing system. Last year, the company incurred $100,000 in overhead costs. Detailed information about these costs is as follows:

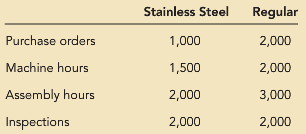

The company made 500 stainless steel grills and 1,000 regular grills last month and tracked the number of purchase orders, machine hours, assembly hours, and inspections consumed by each model as follows:

If the production of a regular grill requires 2 purchase orders, 1 machine hour, 1.5 assembly hours, and 1 inspection, how much total overhead cost should be allocated to the unit?

a. $29.43

b. $39.93

c. $33.33

d. none of the above

6. Which of the following statements regarding activity-based costing (ABC) systems in a just-in-time (JIT) environment is true?

a. ABC should not be utilized in a JIT environment.

b. ABC can be very successful in a JIT environment because most overhead costs in such a setting are typically facility-level costs.

c. Combining ABC and JIT should result in very accurate product costing.

d. Both b and c are true statements.

7. Which of the following statements comparing traditional and activity-based costing (ABC) systems is true?

a. Traditional systems are generally more accurate than ABC systems.

b. ABC systems are generally more accurate than traditional systems.

c. ABC and traditional systems often produce similar product-cost information.

d. None of the above is true.

8. Which of the following statements comparing traditional and activity-based costing (ABC) is true?

a. ABC systems eliminate cross subsidies.

b. Traditional systems eliminate cross subsidies.

c. ABC and traditional systems often produce similar product-cost information.

d. Each of the above is true.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins