Multiple Choice Questions 1. Each of the following statements describes the relationship between IRR and NPV. Identify

Question:

1. Each of the following statements describes the relationship between IRR and NPV. Identify the correctly worded statement.

a. The IRR is the discount rate that results in a zero NPV.

b. The IRR is the discount rate that results in a positive NPV.

c. The IRR is equal to the company€™s cost of capital used in NPV calculations.

d. None of the above statements is correctly worded.

2. Screening decisions involve:

a. Choosing between alternatives

b. Identifying objectives

c. Defining a problem

d. Deciding whether an investment meets a predetermined criterion

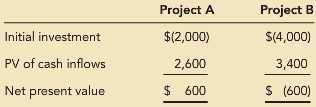

3. You are considering the following two projects:

Calculate a profitability index for each project and determine which is/are acceptable?

a. A only

b. B only

c. A and B

d. neither A nor B

4. Preference decisions involve:

a. Choosing between alternatives

b. Identifying objectives

c. Defining a problem

d. Deciding whether an investment meets a predetermined criterion

5. A company purchased a piece of manufacturing equipment for which it will record annual depreciation of $45,000. What is the tax savings related to this equipment if the company€™s tax rate is 35 percent?

a. $29,250

b. $45,000

c. $15,750

d. None of the above.

6. If Warner Enterprises is in the 40 percent tax bracket and has a 10 percent rate of return, its after-tax benefit should be calculated by using a rate of return of:

a. 6 percent

b. 10 percent

c. 40 percent

d. 60 percent

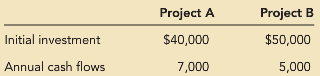

7. Your company has a policy of accepting projects with a payback period of seven years or less. Which of the following projects would be acceptable?

a. A only

b. B only

c. A and B

d. neither A nor B

8. Which of the following capital investment evaluation techniques does not require the use of discounted cash flows?

a. IRR

b. NPV

c. payback period

d. Each of the above requires discounted cashflows.

Discounted Cash FlowsWhat is Discounted Cash Flows? Discounted Cash Flows is a valuation technique used by investors and financial experts for the purpose of interpreting the performance of an underlying assets or investment. It uses a discount rate that is most... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins