Multiple Choice Questions 1. Which of the following statements about ratio analysis is not true? a. Financial

Question:

Multiple Choice Questions

1. Which of the following statements about ratio analysis is not true?

a. Financial ratios can show how a company has done in the past but are not very useful in predicting its future direction and financial position.

b. The most compelling reason to analyze financial statements is simply that it provides useful information to supplement information directly provided in financial statements.

c. Financial statement analysis involves the application of analytical tools to financial statements and to the supplemental data included with the financial statements to enhance the ability of decision makers to make optimal decisions.

d. For both internal and external users, financial statement analysis enhances the usefulness of the information contained in the financial statements.

2. Which of the following is not a limitation of financial statement analysis?

a. When comparing companies, you need to take into consideration differences in accounting methods and cost flow assumptions.

b. Financial statement analysis involves the application of analytical tools to financial statements and to the supplemental data included with the financial statements to enhance the ability of decision makers to make optimal decisions.

c. In order to properly prepare and interpret financial statement ratios, these methods, estimates, and assumptions must be taken into consideration.

d. Ratios must be looked at as a story that can’t be told without all the pieces.

3. To perform horizontal analysis:

a. Dollar changes and percentage changes in each item on the balance sheet are often provided.

b. Common-size financial statements are prepared.

c. Return on investment (ROI), residual income, and economic value added (EVA) are computed.

d. Each of the above is true.

4. Which of the following statements regarding trend analysis is not true?

a. Many annual reports include, as supplemental information, up to 10 years of financial data that can be used to perform trend analysis.

b. Decision makers can use trend analysis to build prediction models to forecast financial performance.

c. Trend analysis is also known as vertical analysis.

d. Trend analysis can be used to identify problem areas by looking for sudden or abnormal changes in accounts.

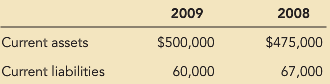

5. Achmed’s Animations had current assets and current liabilities in 2009 and 2008 as follows:

The amount of working capital from 2008 to 2009 was:

a. Increased by $25,000

b. Decreased by $7,000

c. Increased by $32,000

d. Decreased by $32,000

6. Carla’s Creations had sales of $950,000 and net operating income of $575,000 last year. If operating assets during that year averaged $450,000, Carla’s Creations’ asset turnover is:

a. 0.605

b. 0.783

c. 1.277

d. 2.111

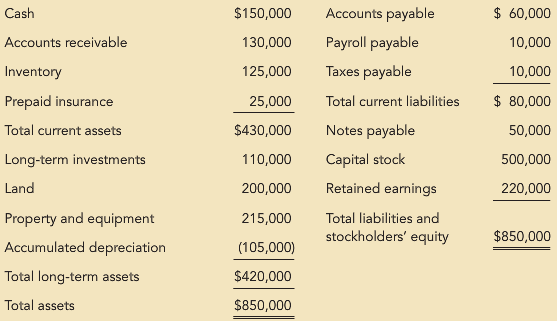

Use the following information from Paddington’s 12/31/09 financial statements to answer questions 7, 8, and 9:

7. Paddington’s current ratio is:

a. 5.375

b. 3.81

c. 3.50

d. It cannot be determined from the information provided.

8. Paddington’s acid-test ratio is:

a. 5.375

b. 3.81

c. 3.5

d. It cannot be determined from the information provided.

9. Paddington’s debt-to-equity ratio is:

a. 0.10

b. 0.11

c. 0.18

d. It cannot be determined from the information provided.

10. Brown’s Breads had the following financial statement information for 2009:

Net sales ………………………………… $1,500,000

Gross profit margin ……………………… 1,250,000

Interest expense (net of tax) …………….. 240,000

Net income ………………………………. 900,000

Total assets, 12/31/08 ……………………. 1,010,000

Total assets, 12/31/09 ……………………. 1,200,000

Total liabilities, 12/31/09 ………………… 260,000

Stockholders’ equity, 12/31/08 …………... 650,000

Stockholders’ equity, 12/31/09 …………… 750,000

Preferred dividends ………………………. 100,000

Average number of shares outstanding …… 1,000,000

The return on common stockholders’ equity for Brown’s Breads is:

a. 1.14

b. 1.20

c. 1.38

d. It cannot be determined from the information provided.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio. Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Financial Ratios

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Step by Step Answer:

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins