Multiple Choice Questions 1. Which of the following statements is true with respect to when a product

Question:

Multiple Choice Questions

1. Which of the following statements is true with respect to when a product should be dropped?

a. A product should be dropped when fixed costs avoided are less than the contribution margin lost.

b. A product should be dropped when variable costs and contribution margin are equivalent.

c. A product should be dropped when fixed costs avoided are greater than the contribution margin lost.

d. A product should be dropped when fixed costs are less than variable costs.

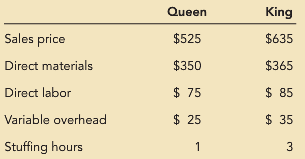

2. Soft Mattress, Inc., produces both a queen- and a king-size soft bed. Selected data related to each product follow:

The two employees who are trained to stuff the secret soft ingredient into the mattresses have a maximum of 4,000 stuffing hours per year. If demand were strong for both beds and the company could sell an unlimited number of units produced for either style, which beds should be produced?

a. 4,000 queen-size beds

b. 4,000 king-size beds

c. 1,333 king-size beds

d. 2,000 queen-size beds and 667 king-size beds

3. Resource utilization decisions:

a. Are typically long-term in nature

b. Typically involve significant and irreversible commitments of resources

c. Are typically short-term decisions

d. Are not sufficiently described by any of the above statements

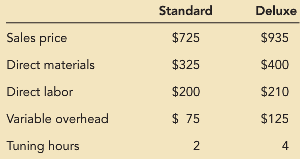

4. Novakoske Electronics produces Standard and Deluxe model televisions. Selected data related to each product follow.

Television tuning is performed on one of four expensive tuning machines that can operate a maximum of 8,000 tuning hours per year. What is the contribution margin per limited resource for each type of television?

a. $125 for Standard and $200 for Deluxe

b. $200 for Standard and $125 for Deluxe

c. $62.50 for Standard and $50 for Deluxe

d. $50 for Standard and $62.50 for Deluxe

5. Resource utilization decisions require managers to maximize:

a. Gross profit per unit produced

b. contribution margin per unit produced

c. contribution margin per unit of scarce resource

d. Gross profit per unit of scarce resource

6. Which of the following is most likely to represent a bottleneck?

a. A production machine that is underutilized.

b. A workstation that requires significant supervision.

c. A production machine that has limited capacity.

d. An employee who has 1 hour of idle time each day.

7. Canned Foods Unlimited is deciding whether to sell its canned corn in whole kernels or to process it further into creamed corn. The cost of producing whole kernel corn is $0.20 per can, and the can sells for $0.40. Additional processing costs to produce creamed corn are $0.06 per can, and each can sells for $0.45. Which of the following costs is relevant in this decision whether to sell or process further?

a. $0.20 production cost

b. $0.06 additional processing cost

c. Both A and B are relevant.

d. Neither A nor B is relevant.

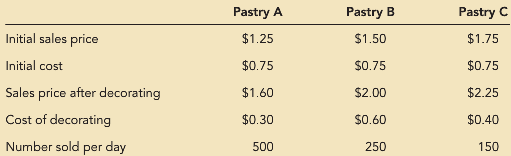

8. Bakery Creations has three pastries that can be sold immediately either after baking or after being decorated. All pastries sell whether presented as baked or as decorated. The following sales and cost information is provided:

Which pastries should be processed further?

a. A only

b. A, B, and C

c. B and C

d. A and C

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins