Multiple Choice Questions Identify the best answer for each of the following: 1. Which of the following

Question:

Multiple Choice Questions

Identify the best answer for each of the following:

1. Which of the following is a characteristic of a Special Revenue Fund that differentiates it from a General Fund?

a. A Special Revenue Fund is required to be budgeted on a multi-year basis.

b. A Special Revenue Fund is established only if a revenue source is restricted or committed to expenditure for a specific purpose other than debt service and capital outlay.

c. A governmental entity may only have one Special Revenue Fund.

d. A Special Revenue Fund uses the total economic resources measurement focus.

2. The net revenue approach can be best described as

a. Being consistent with the reporting of revenues in the private sector.

b. Evidenced by the recognition of bad debt expense for revenues earned but deemed uncollectible by a governmental fund.

c. The reporting of a reduction of revenue for those revenues deemed to be uncollectible.

d. The approach used to account for uncollectible revenues in both governmental and proprietary funds.

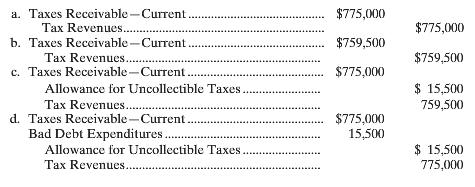

3. Assume that Nathan County has levied its current year taxes and all revenue recognition criteria for property taxes have been met. The amount levied was $775,000, of which 2% is deemed to be uncollectible (based on historical experience). Which of the following entries would be made in the General Fund?

4. Refer to the previous question. What amount of tax revenues should be recorded in the

Revenues Subsidiary Ledger for the transaction?

a. $744,310.

b. $759,500.

c. $775,000.

d. $0—revenues should only be recorded in the Revenues Subsidiary Ledger when the cash is actually received.

5. Assume the following transactions that affected the General Fund and the Special Revenue Fund took place during the year. (a) $50,000 was borrowed from the General Fund for the Special Revenue Fund. The interfund loan will be repaid in equal installments over 10 years, starting next fiscal year. (b) It was discovered that $5,500 of expenditures that were supposed to have been charged to the General Fund were charged to the Special Revenue Fund in error. The error was corrected. (c) The General Fund transferred $8,000 to the Special Revenue Fund during the year. What is the net effect of these transactions or events on total fund balance in the General Fund and Special Revenue Fund, respectively?

a. General Fund balance increased $13,500; the Special Revenue Fund balance decreased $13,500.

b. General Fund balance decreased $63,500; the Special Revenue Fund balance increased $63,500.

c. General Fund balance decreased $13,500; the Special Revenue Fund balance increased $13,500.

d. General Fund balance decreased $36,500; the Special Revenue Fund balance increased $36,500.

6. Which of the following statements is true concerning assigned fund balance?

a. Assigned fund balance reflects a government’s intent to use resources for a specific purpose.

b. Assigned fund balance cannot be negative unless necessary to avoid having a deficit in unassigned fund balance.

c. Reporting assigned fund balance is optional.

d. Items a, b, and c are all true.

7. The GAAP-based statements that are required to be presented for the General Fund are:

a. Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balances.

b. Balance Sheet; Statement of Revenues, Expenditures, and Changes in Fund Balances; and Budget Comparison Statement of Revenues, Expenses, and Changes in Fund Balances.

c. Balance Sheet only.

d. GAAP leave it to management discretion.

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Governmental and Nonprofit Accounting

ISBN: 978-0132751261

10th edition

Authors: Robert Freeman, Craig Shoulders, Gregory Allison, Robert Smi