Multiple Choice Questions Identify the best answer for each of the following: 1. Not-for-profit reporting standards require

Question:

Multiple Choice Questions

Identify the best answer for each of the following:

1. Not-for-profit reporting standards require net assets to be reported in all of the following classes except

a. Unrestricted net assets.

b. Invested in capital assets, net of related debt.

c. Permanently restricted net assets.

d. Temporarily restricted net assets.

2. Which of the following is not a common characteristic of a VHWO?

a. Typically, no fees or only minimal fees are charged for services a VHWO provides.

b. Resource providers are typically the primary recipients of the VHWO’s services.

c. A VHWO may be governmental or nongovernmental in nature.

d. A VHWO’s primary purpose is to meet a community health, welfare, or other social need.

3. Securities donated to a VHWO should be recorded at the

a. Donor’s recorded amount.

b. Fair market value at the date of the gift.

c. Fair market value at the date of the gift or the donor’s book value, whichever is lower.

d. Fair market value at the date of the gift or the donor’s book value, whichever is higher.

Questions 4 and 5 are based on the following data:

The Charles Vernon Eames Community Service Center is a nongovernment VHWO financed by contributions from the general public. During 20X5, unrestricted pledges of $900,000 were received, half of which were payable in 20X5, with the other half payable in 20X6 for use in 20X6. It was estimated that 10% of these pledges would be uncollectible. In addition, Louease Jones, a social worker, contributed 800 hours of her time to the center at no charge to assist with fund-raising activities. Jones’s annual social worker salary is $20,000 based on a workload of 2,000 hours.

4. How much should the center report as contributions revenue for 20X5 from the pledges?

a. $0

b. $405,000

c. $810,000

d. $413,000

5. How much should the center record in 20X5 for contributed service expense?

a. $8,000

b. $4,000

c. $800

d. $0

6. Cura Foundation, a nongovernment VHWO supported by contributions from the general public, included the following costs in its Statement of Functional Expenses for the year ended December 31, 20X6:

Fund-raising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $500,000

Administrative (including data processing) . . . . . . . . . .300,000

Research . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,000

Cura’s functional expenses for 20X6 program services were

a. $900,000.

b. $500,000.

c. $300,000.

d. $100,000.

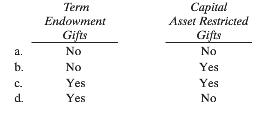

7. The permanently restricted net assets of an ONPO include net assets from which of the following?

8. During the years ended June 30, 20X5, and 20X6, a nongovernment ONPO conducted a cancer research project financed by a $2,000,000 restricted gift. This entire amount was pledged by the donor on July 10, 20X3, although he paid only $500,000 at that date. During the two-year research period, the ONPO-related gift receipts and research expenses were as follows:

How much temporarily restricted contributions revenue should the ONPO report in its

Statement of Activities for the year ended June 30, 20X6?

a. $0

b. $800,000

c. $1,100,000

d. $2,000,000

9. What amount of net assets released from restrictions should the ONPO in question 8 report in its Statement of Activities for 20X6?

a. $0

b. $800,000

c. $1,100,000

d. $2,000,000

10. A nongovernment VHWO received an unconditional pledge in 20X5 from a donor specifying that the amount pledged be used in 20X7. The donor paid the pledge in cash in 20X6. The pledge should be reflected in

a. Temporarily restricted net assets in the Balance Sheet at the end of 20X5, and in unrestricted net assets at the end of 20X6.

b. Temporarily restricted net assets in the Balance Sheet at the end of 20X5 and 20X6, and in unrestricted net assets at the end of 20X7.

c. In unrestricted net assets at the end of 20X5.

d. Net assets only after collected in 20X6.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Governmental and Nonprofit Accounting

ISBN: 978-0132751261

10th edition

Authors: Robert Freeman, Craig Shoulders, Gregory Allison, Robert Smi