Multiple-Choice Questions 1. The basic purpose of accounting is to: a. Minimize the amount of taxes a

Question:

Multiple-Choice Questions

1. The basic purpose of accounting is to:

a. Minimize the amount of taxes a company has to pay.

b. Permit an organization to keep track of its economic activities.

c. Report the largest amount of earnings to stockholders.

d. Reduce the amount of risk experienced by investors.

2. A primary purpose of all organizations in our society is to:

a. Make a profit.

b. Minimize the payment of taxes.

c. Provide employment for the largest number of workers possible.

d. Create value by transforming resources from one form to another.

3. Value is created when organizations:

a. Raise capital by borrowing funds from banks, individuals, or other businesses.

b. Pay cash to suppliers, employees, owners, and government.

c. Sell products or services at prices that exceed the value of resources consumed.

d. Invest in machinery.

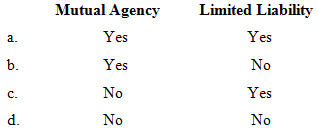

4. Which of the following are features of the corporate form of business organization?

5. Tammy Faye invested $2,000 in a partnership. One year later, the partnership was sold, and cash from the sale was distributed to the partners. On that date, Tammy received a check for her share of the company in the amount of $2,250. What was Tammy’s return on investment?

a. $0

b. $250

c. $2,000

d. $2,250

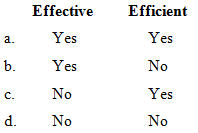

6. Sternberg Enterprises developed a new type of roller skate that is very popular because of its high quality and reasonable price. Sternberg is losing money on the product, however, because several key production personnel recently resigned and replacements are not as skilled. Which of the following terms properly describe the firm?

7. The transformation of resources refers to:

a. The assessment of employee performance.

b. Converting resources from one form to a more valuable form.

c. Procedures designed to reduce a company’s risk.

d. Training methods by which unskilled workers become efficient and effective.

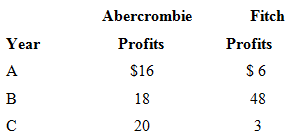

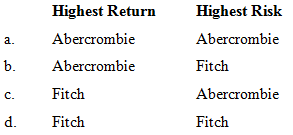

8. An investor is evaluating the potential investments described below. Past financial results of these two companies are judged to be indicative of future returns and risk.

From the information provided, which investment appears to have the higher return and which the higher risk?

9. SEC stands for:

a. Securities Excellence Commission

b. Securities and Exchange Commission

c. Standard Executive Compensation

d. Salaried Executive’s Council

10. Ethical behavior is particularly important for accounting because:

a. Companies cannot detect unethical behavior.

b. If the reports are wrong, accountants may have to go to jail.

c. The SEC cannot carefully audit each company’s financial statements.

d. The reliability of accounting information depends on the honesty of those who prepare, report, and audit this information.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Financial Accounting Information For Decisions

ISBN: 978-0324672701

6th Edition

Authors: Robert w Ingram, Thomas L Albright