Nashville Tool Company is considering installation of a CIM system as part of its implementation of a

Question:

Nashville Tool Company is considering installation of a CIM system as part of its implementation of a JIT philosophy. Gretchen Torres, company president, is convinced that the new system is necessary, but she needs the numbers to convince the board of directors. This is a major move for the company, and approval at board level is required.

Maria, Gretchen’s daughter, has been assigned the task of justifying the investment. She is a business school graduate and understands the use of NPV for capital-budgeting decisions. To identify relevant costs, she developed the following information.

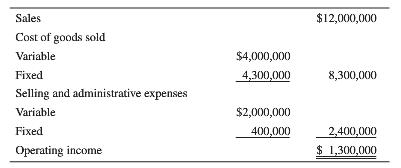

Nashville Tool Company produces a variety of small automobile components and sells them to auto manufacturers. It has a 40% market share, with the following condensed results expected for 2011:

Installation of the CIM system will cost $6 million, and the company expects the system to have a useful life of 6 years with no salvage value. Installation will occur at the beginning of 2012. In 2012, the training costs for personnel will exceed any cost savings by $400,000. In years 2013–2017, variable cost of goods sold will decrease by 35%, an annual savings of $1.4 million. There will be no savings in fixed cost of goods sold—it will increase by the amount of the straight-line depreciation on the new system. Selling and administrative expenses will not be affected. The required rate of return is 12%. Assume that all cash flows occur at the end of the year the revenue or expense is recognized, except the initial investment, which occurs at the beginning of 2012. Ignore income taxes.

1. Suppose that Maria assumes that production and sales would continue for the next 6 years as they are expected in 2011 in the absence of investment in the CIM. Compute the NPV of investing in the CIM.

2. Now suppose Maria predicts that it will be difficult to compete without installing the CIM. She has undertaken market research that estimates a drop in market share of three percentage points a year starting in 2012 in the absence of investment in the CIM (i.e., market share will be 37% in 2012, 34% in 2013, 31% in 2014, etc.). Her study also showed that the total market sales level will stay the same, and she does not expect market prices to change. Compute the NPV of investing in the CIM.

3. Prepare a memo from Maria to the board of directors of Nashville Tool Company. In the memo, explain why the analysis in number 2 is appropriate and why analyses such as that in number 1 cause companies to underinvest in high-technology projects. Include an explanation of qualitative factors that are not included in the NPV calculation.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta