Oakridge Ltd. gained control of Ventnor Ltd. by acquiring its share capital on January 1, 2009. The

Question:

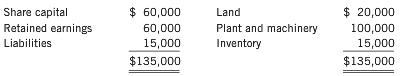

Oakridge Ltd. gained control of Ventnor Ltd. by acquiring its share capital on January 1, 2009. The statement of ï¬nancial position of Ventnor at that date showed:

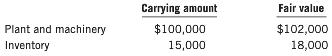

At January 1, 2009, the recorded amounts of Ventnor€™s assets and liabilities were equal to their fair values except as follows:

All this inventory was sold by Ventnor in the following three months. The depreciable assets have a further ï¬ve year life, beneï¬ts being received evenly over this period. The tax rate is 30%.

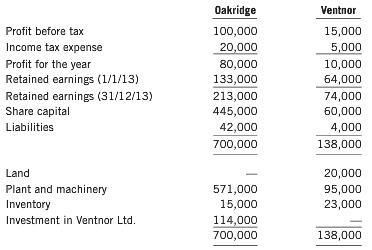

At December 31, 2013, the following information was obtained from both entities:

Required

Prepare the consolidated ï¬nancial statements for Oakridge Ltd. at December 31, 2013.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: