October 20X1, Little Raven plc issued 50,000 debentures , with a par value of 100 each, to

Question:

October 20X1, Little Raven plc issued 50,000 debentures, with a par value of £100 each, to investors at £80 each. The debentures are redeemable at par on 30 September 20X6 and have a coupon rate of 6%, which was significantly below the market rate of interest for such debentures issued at par. In accounting for these debentures to date, Little Raven plc has simply accounted for the cash flows involved, namely:

◠On issue: Debenture ‘liability’ included in the statement of financial position at £4,000,000.

◠Statements of comprehensive income: Interest charged in years ended 30 September 20X2, 20X3 and 20X4 (published accounts) and 30 September 20X5 (draft accounts) − £300,000 each year (being 6% on £5,000,000).

The new finance director, who sees the likelihood that further similar debenture issues will be made, considers that the accounting policy adopted to date is not appropriate. He has asked you to suggest a more appropriate treatment.

Little Raven plc intends to acquire subsidiaries in 20X6.

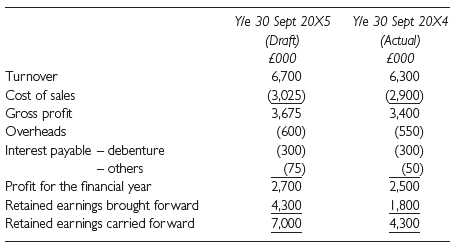

Statements of comprehensive income for the years ended 30 September 20X4 and 20X5 are as follows:

debentures, with a" class="fr-fic fr-dii">

debentures, with a" class="fr-fic fr-dii">

Extracts from the statement of financial position are:

Required:

(a) Outline the considerations involved in deciding how to account for the issue, the interest cost and the carrying value in respect of debenture issues such as that made by Little Raven plc. Consider the alternative treatments in respect of the statement of comprehensive income and refer briefly to the appropriate statement of financial position disclosures for the debentures. Conclude in terms of the requirements of IAS 32 (on accounting for financial instruments) in this regard.

(b) Detail an alternative set of entries in the books of Little Raven plc for the issue of the debentures and subsequently; under this alternative the discount on the issue should be dealt with under the requirements of IAS 32. The constant rate of interest for the allocation of interest cost is given to you as 11.476%. Draw up a revised statement of comprehensive income for the year ended 30 September 20X5 – together with comparatives – taking account of the alternative accountingtreatment.

DebenturesDebenture DefinitionDebentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who... Coupon

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott